“FICO Scores and Credit Scores: A Comprehensive

Guide to Financial Evaluation!”

Introduction: Understanding credit scores

When it comes to understanding your financial health, credit scores play a crucial role. They provide lenders with an insight into your creditworthiness and help determine the terms and conditions of loans and credit cards you may apply for. But what exactly are credit scores? Now Hiring $30 Per Hour Facebook Chat Assistant!

What is a FICO score?

A FICO score is a type of credit score that is widely used by lenders to assess an individual’s creditworthiness. The term “FICO” stands for Fair Isaac Corporation, the company that developed this scoring model. FICO scores range from 300 to 850, with higher scores indicating better creditworthiness. Lenders often consider FICO scores when evaluating applications for mortgages, auto loans, and credit cards.

What is a credit score?

Credit scores, on the other hand, are an overall representation of an individual’s creditworthiness. They are calculated based on various factors, including payment history, credit utilization, length of credit history, types of credit used, and new credit applications. While FICO scores are a type of credit score, there are also other credit scoring models such as VantageScore that lenders may use.

The difference between FICO scores and credit scores

While FICO scores are a specific type of credit score, the main difference lies in the scoring models used. FICO scores are calculated using the Fair Isaac Corporation’s proprietary algorithm, whereas credit scores can be calculated using different models such as VantageScore. The range of credit scores may also differ depending on the scoring model used.

It is essential to note that FICO scores are more widely used by lenders, making them a crucial factor in determining your creditworthiness. However, both FICO scores and credit scores aim to provide a snapshot of your creditworthiness and help lenders assess the risk of lending to you.

How FICO scores are calculated

FICO scores are calculated using five main factors: payment history, amounts owed, length of credit history, new credit, and credit mix. Each factor carries a different weight in the calculation, with payment history being the most significant. Paying bills on time, keeping credit card balances low, maintaining a long credit history, and avoiding opening too many new accounts can positively impact your FICO score.

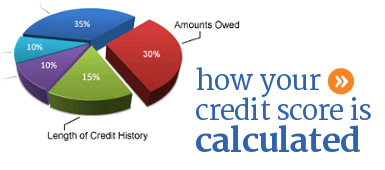

How credit scores are calculated

Credit scores, regardless of the scoring model used, consider similar factors when calculating your creditworthiness. Payment history, credit utilization, length of credit history, types of credit used, and new credit applications all play a role in determining your credit score. However, the weight given to each factor and the specific calculations may vary depending on the scoring model used.

Importance of credit scores and FICO scores

Credit scores and FICO scores are essential because they provide lenders with an objective measure of your creditworthiness. A higher credit score indicates that you are less risky to lend to, which can result in more favorable loan terms and lower interest rates. On the other hand, a lower credit score may limit your borrowing options and lead to higher interest rates or even loan denials.

Furthermore, credit scores and FICO scores are not only important when applying for loans or credit cards. Landlords, insurance companies, and even potential employers may also consider your creditworthiness when making decisions. Therefore, maintaining a good credit score and FICO score is crucial for your financial well-being.

Factors that impact credit scores and FICO scores

Several factors can impact both credit scores and FICO scores. Payment history, which includes any late payments or delinquencies, has the most significant influence. The amount of debt you owe, the length of your credit history, the types of credit you have, and any new credit applications can also affect your scores. It is essential to understand how these factors impact your creditworthiness and take steps to improve them if necessary. Post images on Social media for $200 per day

How to improve your credit score and FICO score

Improving your credit score and FICO score requires a combination of responsible financial habits and patience. Start by making all your bill payments on time and in full. Reduce your credit card balances and avoid maxing out your credit limits. Maintain a healthy mix of credit accounts and avoid opening too many new accounts at once. Finally, regularly review your credit reports for errors and dispute any inaccuracies you find.

Monitoring and managing your credit and FICO scores

Monitoring your credit score and FICO score is crucial to staying on top of your financial health. Regularly check your credit reports from the major credit bureaus and review them for any discrepancies or signs of identity theft. Many credit card companies and financial institutions provide free access to credit scores, allowing you to track your progress. Use this information to manage your credit effectively and make informed financial decisions.

Common misconceptions about credit scores and FICO scores

There are several common misconceptions when it comes to credit scores and FICO scores. One common myth is that checking your credit score will negatively impact it. This is not true; checking your own credit score is considered a “soft inquiry” and does not affect your score. Another misconception is that closing a credit card will automatically improve your credit score. In some cases, it may actually harm your score by reducing your overall credit limit and shortening your credit history.

Conclusion

Understanding the differences between FICO scores and credit scores is crucial for navigating the world of financial evaluation. While FICO scores are a specific type of credit score, both play an essential role in determining your creditworthiness. By understanding how these scores are calculated and taking steps to improve them, you can enhance your financial health and open doors to better loan terms and opportunities. $800/week for trying out filters on Snapchat

FAQs

Q: What is a good credit score?

A: A good credit score typically falls within the range of 670 to 850. However, it is important to note that different lenders may have different criteria for what they consider a good credit score. It is always best to aim for the highest credit score possible to increase your chances of securing favorable loan terms.

Q: How long does it take to improve a credit score?

A: The time it takes to improve a credit score can vary depending on individual circumstances. Generally, it may take several months of responsible credit behavior, such as making on-time payments and reducing debt, to see a noticeable improvement. However, significant improvements may take longer, especially if there are negative marks on your credit report.

Q: Can I improve my credit score quickly?

A: While it may not be possible to improve your credit score overnight, there are steps you can take to expedite the process. Focus on paying bills on time, reducing credit card balances, and avoiding new credit applications. Additionally, regularly monitoring your credit report for errors and promptly disputing any inaccuracies can help improve your score more quickly.

National Stats

- According to recent statistics, the average FICO score in the United States is around 711, indicating good creditworthiness.

- Around 30% of Americans have a credit score below 670, which may limit their borrowing options and result in higher interest rates.

- Younger individuals tend to have lower credit scores, with the average score for those aged 18-29 being around 652.

- On the other hand, individuals aged 60 and older have the highest average credit scores, with a score of around 743.

Take control of your financial future by understanding and monitoring your credit score and FICO score. Start by checking your credit reports regularly and taking steps to improve your creditworthiness. With responsible financial habits and a focus on maintaining good credit, you can pave the way for a brighter financial future.