Elevate Your Credit Score: Unveiling the Power

of Becoming an Authorized User!

Introduction to Credit Scores

Credit scores play a crucial role in our financial lives. They determine our eligibility for loans, credit cards, and even rental agreements. A good credit score opens doors to better interest rates and more favorable terms, while a poor credit score can limit our financial opportunities. Understanding how credit scores work is essential for anyone looking to improve their financial standing. In this article, we will explore the power of becoming an authorized user and how it can elevate your credit score.

Understanding the Role of Authorized Users in Credit Scores

Before we delve into the benefits of becoming an authorized user, let’s first understand what it means to be one. An authorized user is someone who is granted access to another person’s credit account. This person is not responsible for the debt incurred on the account but shares the credit history associated with it. When a primary account holder adds an authorized user to their account, the credit activity of that account, including payment history and credit utilization, is reported on both the primary account holder’s credit report and the authorized user’s credit report.

Benefits of Becoming an Authorized User

Becoming an authorized user can have several advantages when it comes to improving your credit score. Firstly, it allows you to piggyback off the positive credit history of the primary account holder. If the primary account holder has a long and positive credit history, adding you as an authorized user can instantly boost your credit score. Additionally, being associated with a credit account in good standing can help establish your creditworthiness, especially if you are new to credit or have a limited credit history.

Secondly, becoming an authorized user can help improve your credit utilization ratio. This ratio is the amount of credit you are using compared to the total credit available to you. By being added as an authorized user to an account with a high credit limit and low utilization, your overall credit utilization ratio can decrease, which is beneficial for your credit score. Lenders view a low credit utilization ratio as a sign of responsible credit management. How to make $1,000 per day on complete auto-pilot 24/7

Lastly, being an authorized user can provide you with an opportunity to learn about credit management from the primary account holder. You can observe their spending habits, payment strategies, and overall financial behavior. This knowledge can empower you to make smarter financial decisions and develop good credit habits for your own future.

Steps to Become an Authorized User

Now that you understand the benefits, let’s explore the steps to become an authorized user. The process usually involves a few simple steps:

- Find someone willing to add you as an authorized user: This can be a family member, a close friend, or even a spouse. It’s important to choose someone who has a good credit history and is responsible with their credit.

- Discuss the arrangement: Have a conversation with the primary account holder to ensure both parties are clear on the expectations and responsibilities associated with being an authorized user. It’s crucial to establish trust and open communication.

- Provide necessary information: The primary account holder will need your personal information, such as your full name, date of birth, and social security number, to add you as an authorized user. Make sure to provide accurate information to avoid any complications.

- Wait for the account to reflect on your credit report: Once you have been added as an authorized user, it may take some time for the account to appear on your credit report. Patience is key during this waiting period.

- Monitor your credit report: Regularly check your credit report to ensure that the authorized user account is accurately reflected. Monitoring your credit report allows you to identify any errors or discrepancies and take necessary actions to rectify them.

Risks and Considerations of Becoming an Authorized User

While becoming an authorized user can be advantageous, it’s essential to consider the potential risks involved. One risk is that the primary account holder may not manage the account responsibly, which could negatively impact your credit score. It’s crucial to have open communication with the primary account holder and establish trust before becoming an authorized user.

Another consideration is that not all credit card issuers report authorized user accounts to the credit bureaus. Before becoming an authorized user, it’s important to verify with the credit card issuer that they report authorized user accounts to the credit bureaus. Otherwise, the positive impact on your credit score may be limited.

Additionally, becoming an authorized user on someone else’s account can potentially affect your ability to qualify for certain loans or credit cards in the future. Some lenders may view being an authorized user as a sign of reliance on someone else’s credit, which could raise concerns about your financial independence.

Strategies to Maximize the Benefits of Being an Authorized User

To maximize the benefits of being an authorized user, consider implementing the following strategies:

- Choose the right primary account holder: Select someone with a long and positive credit history, low credit utilization, and responsible credit management habits.

- Monitor the account activity: Regularly check the account activity to ensure that the primary account holder is managing the account responsibly. If you notice any concerning behavior, address it promptly.

- Maintain your own responsible credit habits: While being an authorized user can help boost your credit score, it’s important to continue practicing responsible credit habits on your own. Pay your bills on time, keep your credit utilization low, and avoid taking on more debt than you can handle.

- Gradually establish your own credit accounts: As you build your credit history as an authorized user, consider applying for your own credit cards or loans to further strengthen your credit profile. This will demonstrate your ability to manage credit independently. $25 an Hour Chat on Twitter Job!

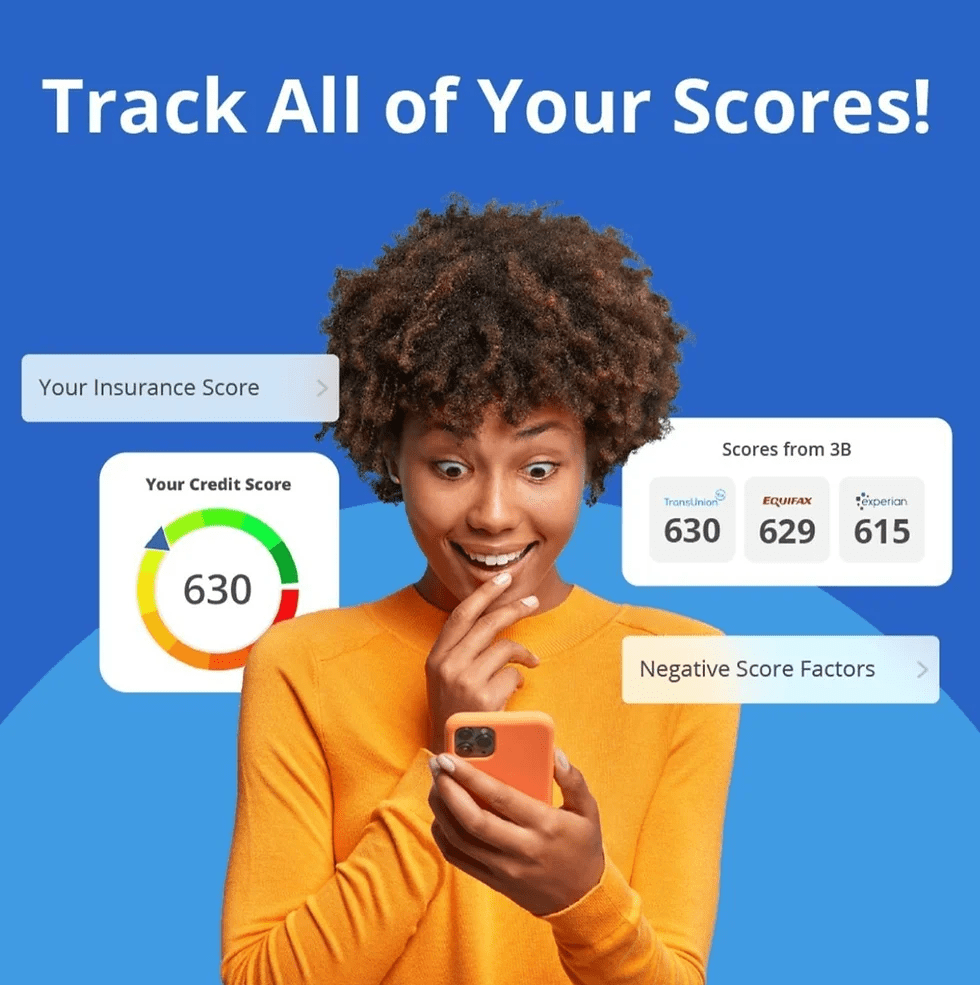

How to Monitor and Track the Impact on Your Credit Score

Monitoring and tracking the impact of being an authorized user on your credit score is crucial to ensure that the strategy is working in your favor. Here are some steps to help you monitor and track the impact:

- Regularly check your credit reports: Obtain a copy of your credit reports from the three major credit bureaus – Experian, TransUnion, and Equifax. Review the reports for any changes or updates related to the authorized user account.

- Analyze your credit score: Keep track of your credit score over time to gauge the impact of being an authorized user. Look for any significant changes and identify any areas for improvement.

- Utilize credit monitoring services: Consider using credit monitoring services that provide real-time updates on your credit score and any changes to your credit reports. These services can alert you to any suspicious activity or errors.

- Maintain open communication with the primary account holder: Stay in touch with the primary account holder to discuss any changes or updates related to the authorized user account. Address any concerns or discrepancies promptly.

Other Ways to Improve Your Credit Score

While becoming an authorized user can be a powerful tool for improving your credit score, it’s not the only method available. Here are some other ways you can work towards a better credit score:

- Pay your bills on time: Late payments can have a significant negative impact on your credit score. Make it a priority to pay your bills on time, every time.

- Keep your credit utilization low: Aim to keep your credit utilization ratio below 30%. This means using only a portion of your available credit and avoiding maxing out your credit cards.

- Minimize new credit applications: Opening multiple new credit accounts within a short period can raise concerns for lenders. Minimize new credit applications unless necessary.

- Monitor your credit reports for errors: Regularly review your credit reports for any errors or inaccuracies. Dispute any discrepancies promptly to ensure your credit report reflects accurate information.

- Diversify your credit mix: Having a diverse range of credit accounts, such as credit cards, loans, and a mortgage, can demonstrate your ability to manage different types of credit.

Common Misconceptions About Authorized Users

There are several misconceptions surrounding authorized users. Let’s debunk some of the most common ones:

- Authorized users are responsible for the debt: As an authorized user, you are not legally responsible for the debt incurred on the account. The primary account holder remains responsible for any outstanding balances.

- Being an authorized user will automatically improve your credit score: While being an authorized user can have a positive impact on your credit score, it’s not a guarantee. Other factors, such as your own credit habits, also play a significant role. Post images on Social media for $200 per day

- Authorized user accounts can be removed from your credit report at any time: Once you are added as an authorized user, the account will typically remain on your credit report for as long as it remains open. However, this can vary depending on the credit card issuer’s reporting policies.

FAQs

- Can being an authorized user hurt my credit score?

While being an authorized user generally has a positive impact on your credit score, there are instances where it can hurt your score. If the primary account holder mismanages the account or has a history of late payments, it could negatively affect your credit score.

- How long does it take for the authorized user account to appear on my credit report?

The time it takes for the authorized user account to appear on your credit report can vary. It may take anywhere from a few weeks to a few months. Patience is key during this waiting period.

- Can I become an authorized user if I have bad credit?

Yes, becoming an authorized user can still benefit your credit score even if you have bad credit. However, it’s important to choose a primary account holder with a good credit history to maximize the positive impact.

National Stats

According to recent national statistics, approximately 30% of Americans have credit scores below 601, which is considered poor. This highlights the need for effective credit-building strategies, such as becoming an authorized user, to elevate credit scores and improve financial well-being.

Conclusion: Empowering Yourself with the Power of Becoming an Authorized User

Elevating your credit score is within your reach, and becoming an authorized user can be a powerful tool in achieving this goal. By understanding the role of authorized users, weighing the risks and benefits, and implementing effective strategies, you can harness the power of being an authorized user to improve your credit score. Remember to monitor and track the impact on your credit score, explore other credit-building methods, and debunk common misconceptions along the way.

Empower yourself with the knowledge and tools to take control of your credit score and pave the way for a brighter financial future.

Take control of your credit score today by exploring the benefits of becoming an authorized user. Talk to a trusted family member or friend with a good credit history and start your journey towards a better credit score. Remember to practice responsible credit habits and monitor your credit reports regularly. Empower yourself with the power of becoming an authorized user and unlock new financial opportunities.