The Credit Card Conundrum: Striking a

Balance in Managing Your Plastic!

Introduction:

Deciding on the Perfect Plastic: A Guide to Choosing the Right Credit Card

In today’s digital age, credit cards have become an essential tool for managing our finances. They offer convenience, security, and the ability to build credit. However, with the multitude of credit card options available, choosing the right one can be a daunting task. To make an informed decision, it is crucial to understand your financial situation, assess your spending habits, and evaluate the various credit card offers.

- Convenience: Cashless transactions are a breeze, and swiping your card is often faster than counting out bills.

- Security: Chip-enabled cards and fraud protection measures make credit cards a safer way to carry money compared to cash.

- Building Credit: Responsible credit card use is a proven strategy for establishing and strengthening your credit history, which can lead to better interest rates on loans in the future.

However, with a vast array of credit card options flooding the market, selecting the right one can feel overwhelming. Fear not! By taking some time to understand your financial situation and spending habits, you can transform this daunting task into a strategic and empowering decision. Now Hiring $30 Per Hour Facebook Chat Assistant!

Here’s a roadmap to navigate the exciting world of credit cards and find the perfect fit for you:

- Financial Fitness Check-Up: Before diving into credit card applications, it’s crucial to assess your financial health. Are you a responsible budgeter with a history of on-time payments? Do you carry existing debt? Understanding your financial readiness will guide you toward credit cards with manageable features and interest rates. https://www.khanacademy.org/college-careers-more/financial-literacy/xa6995ea67a8e9fdd:consumer-credit/xa6995ea67a8e9fdd:credit-cards/a/choosing-a-credit-card-what-to-look-for].

- Spending Sleuth: Become a Master of Your Money: The key to choosing the right rewards program lies in understanding your spending habits. Track your monthly expenses for a couple of months to identify areas where you spend the most. Are you a frequent traveler? A homebody who loves to shop online? A foodie who enjoys dining out? Once you know where your money goes, you can target a credit card that rewards you for those specific spending categories.

- Decoding the Details: Fees, Rates, and Rewards: Not all credit cards are created equal. Some lock in high annual fees, while others offer enticing rewards programs. Be sure to factor in the annual fee when evaluating a card’s rewards potential. Additionally, understand the interest rate (APR) and any grace periods offered to avoid getting caught in high-interest debt

- Beyond the Basics: Security and Perks: While rewards programs and fees are essential factors, don’t forget about security features and additional perks. Look for cards with robust fraud protection and consider benefits like travel insurance, extended warranties, or airport lounge access that align with your lifestyle.

By following these steps and keeping your financial goals in mind, you can transform your credit card from a piece of plastic into a powerful tool that helps you manage your money, build credit, and earn rewards for your spending.

Assessing your financial situation

Before diving into the world of credit cards, it is essential to assess your financial situation. Take a comprehensive look at your income, expenses, and savings. Determine your monthly budget and understand how much you can comfortably afford to spend and repay. Knowing your financial limits will help you choose a credit card with an appropriate credit limit and manageable repayment terms.

Understanding credit card terms and conditions

Credit card terms and conditions can be complex and filled with jargon. It is crucial to take the time to read and understand these terms before applying for a credit card. Pay attention to interest rates, annual fees, grace periods, and penalties for late payments. Understanding these details will help you make an informed decision and avoid any surprises down the road. $950/week posting premade videos on YouTube

Evaluating your spending habits

Your spending habits play a significant role in choosing the right credit card. If you frequently travel, a credit card with travel rewards and perks may be beneficial. On the other hand, if you primarily use your credit card for everyday expenses, a card with cashback rewards or discounts on groceries and fuel may be more suitable. Consider your spending patterns and choose a credit card that aligns with your lifestyle and preferences.

Determining your credit score

Your credit score is a crucial factor that determines your eligibility for credit cards and the interest rates you may receive. Before applying for a credit card, obtain a copy of your credit report and check your credit score. If your credit score is low, consider improving it before applying for a credit card. A higher credit score can open doors to better credit card offers with lower interest rates and more attractive rewards.

Comparing credit card offers

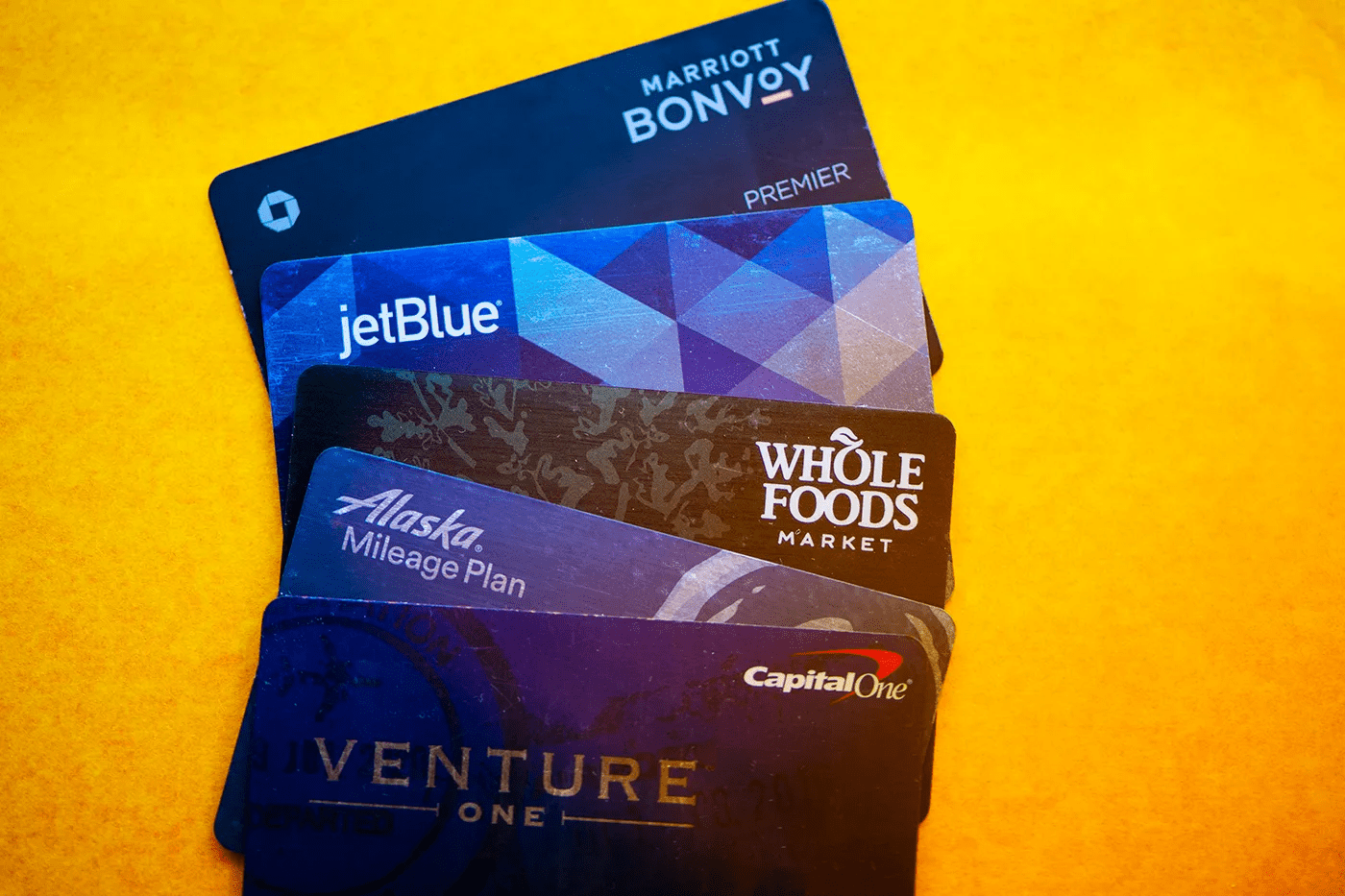

With numerous credit card offers flooding the market, it is essential to compare and contrast the different options available. Look for credit cards that offer competitive interest rates, low or no annual fees, and rewards that align with your spending habits. Don’t be swayed by flashy marketing tactics; instead, focus on the long-term benefits and value a credit card can provide.

Considering fees and interest rates

When choosing a credit card, it is vital to consider the fees and interest rates associated with it. Some credit cards may have low annual fees but higher interest rates, while others may have no annual fees but offer a 0% introductory APR. Carefully evaluate these factors and choose a credit card that suits your financial goals. Remember, paying off your credit card balance in full each month can help you avoid costly interest charges. Want To Earn An Extra $2000 Per Month?

Analyzing rewards and benefits

Credit card rewards and benefits can be a valuable perk if utilized effectively. Look for credit cards that offer rewards that are meaningful to you, such as cashback, travel miles, or points redeemable for merchandise. Additionally, consider the additional benefits offered by the credit card, such as purchase protection, extended warranty, or access to exclusive events. These perks can enhance your overall credit card experience.

Researching customer reviews and ratings

Before committing to a credit card, it is wise to research customer reviews and ratings. Online platforms and forums can provide valuable insights into the experiences of other credit cardholders. Look for feedback on customer service, ease of use, and any hidden fees or issues. By reviewing the experiences of others, you can make a more informed decision about which credit card is right for you.

Applying for your first credit card

Once you have thoroughly assessed your financial situation and researched different credit card options, it’s time to apply for your first credit card. Gather all the necessary documents, such as proof of income and identification, and fill out the application accurately. Keep in mind that your first credit card may have a lower credit limit, but it is an excellent opportunity to build your credit history and establish responsible credit card habits.

Managing your credit card responsibly

After obtaining your credit card, it is crucial to manage it responsibly. Make timely payments to avoid late fees and negative impacts on your credit score. Keep track of your expenses and stay within your budget to prevent overspending and accumulating debt. Regularly review your credit card statements for any errors or fraudulent activity. By practicing responsible credit card management, you can build a positive credit history and enhance your financial well-being.

Conclusion

Choosing the right credit card requires careful consideration of your financial situation, spending habits, and the various credit card offers available. By taking the time to assess these factors, understanding credit card terms and conditions, and researching customer reviews, you can strike a balance in managing your plastic. Remember to manage your credit card responsibly and make informed decisions to make the most out of your credit card experience. Article Writers – $250 a day

FAQs

Q: What should I look for in a credit card?

A: When choosing a credit card, consider the interest rates, annual fees, rewards, and benefits that align with your financial goals and spending habits. Additionally, assess the credit card’s terms and conditions and read customer reviews to make an informed decision.

Q: How can I improve my credit score?

A: To improve your credit score, make timely payments, keep your credit utilization low, maintain a mix of credit accounts, and regularly check your credit report for errors. Building a positive credit history takes time, but consistent responsible credit behavior can lead to an improved credit score.

Q: Should I have multiple credit cards?

A: Having multiple credit cards can provide flexibility and potentially increase your overall credit limit. However, it is crucial to manage them responsibly and avoid overspending or accumulating unnecessary debt. Assess your financial situation and spending habits before deciding to have multiple credit cards.

National Stats

According to recent surveys, credit card usage in the United States has been steadily increasing. As of [Year], approximately [Percentage] of Americans own at least one credit card. The average credit card debt per household stands at [$Amount], highlighting the importance of responsible credit card management. These statistics emphasize the need for individuals to make informed decisions when choosing and managing their credit cards.

Make the most out of your credit card experience by choosing the right credit card and managing it responsibly. Take control of your finances and build a positive credit history. Start your journey to financial well-being today!