Ditching Debt: Your Step-by-Step Guide to

a Financially Liberated Life!

Debt can be a heavy burden, affecting not only your financial well-being but also your overall quality of life. It can restrict your choices, limit your opportunities, and create stress and anxiety. However, with the right approach and a solid plan, you can break free from the chains of debt and achieve financial freedom. In this step-by-step guide, we will explore various strategies to help you ditch debt and pave the way to a financially liberated life. $850 per week for watching movies on Netflix.

The Impact of Debt on Your Financial Well-Being

Debt can have a significant impact on your financial well-being. It can limit your ability to save, invest, and achieve your long-term goals. High-interest debt, such as credit card debt, can quickly accumulate and become unmanageable, leading to a vicious cycle of minimum payments and increasing balances. Not only does this drain your financial resources, but it also hampers your ability to build wealth.

Moreover, debt can take a toll on your mental and emotional well-being. Constantly worrying about bills, creditors, and the future can lead to stress, anxiety, and sleepless nights. It can strain relationships, as financial troubles often spill over into other aspects of life. Recognizing the impact of debt is the first step towards taking control of your financial situation and working towards a debt-free life.

Understanding Different Types of Debt

Before embarking on your debt-free journey, it’s crucial to understand the different types of debt you may have. Not all debt is created equal, and each type may require a different approach for repayment. Common types of debt include credit card debt, student loans, mortgage loans, auto loans, and personal loans.

Credit card debt is one of the most common and expensive forms of debt due to high-interest rates. Student loans, on the other hand, often come with more favorable terms and longer repayment periods. Mortgage loans and auto loans are secured debts, meaning they are backed by collateral (such as your home or car). Personal loans, on the other hand, are unsecured debts and typically have higher interest rates.

By understanding the nature of your debts, you can prioritize repayment and explore the most suitable strategies to eliminate them. Remember, each step you take towards paying off your debts brings you closer to financial freedom.

Step 1: Assessing Your Current Financial Situation

The first step towards ditching debt is assessing your current financial situation. This involves taking stock of your income, expenses, assets, and liabilities. Start by gathering your financial documents, such as bank statements, credit card statements, and loan documents. Calculate your total income, including salary, side hustles, and any passive income. Then, list down all your expenses, including fixed expenses like rent or mortgage payments, utilities, groceries, and discretionary expenses like entertainment and dining out. Write Product Reviews – $40 a review

Next, calculate your net worth by subtracting your liabilities (debts) from your assets (savings, investments, and property). This will give you a clear picture of where you stand financially. It’s important to be honest and thorough during this process, as it will form the foundation for your debt-elimination plan.

Once you have a clear understanding of your financial situation, you can identify areas where you can cut expenses, increase your income, or allocate more funds towards debt repayment. This leads us to the next step: creating a budget.

Step 2: Creating a Budget and Cutting Expenses

Creating a budget is a crucial step in your journey towards financial liberation. A budget helps you allocate your income wisely, prioritize debt repayment, and track your progress. Start by listing all your sources of income and subtracting your fixed expenses, such as rent, utilities, and loan payments. Then, allocate funds towards variable expenses like groceries, transportation, and entertainment. Be sure to include a category for debt repayment.

To cut expenses, scrutinize each category and look for areas where you can trim unnecessary spending. This may involve reducing dining out, canceling unused subscriptions, renegotiating bills, or finding more cost-effective alternatives. Every dollar saved can be put towards paying off your debts faster.

Consider adopting frugal habits and finding joy in simple pleasures that don’t require spending money. Pack your lunch instead of eating out, brew your own coffee instead of buying it daily, and explore free or low-cost activities for entertainment. By embracing a frugal lifestyle, you can accelerate your debt repayment journey and build better financial habits for the long term.

Step 3: Prioritizing and Paying Off High-Interest Debt

Once you have created a budget and identified areas to cut expenses, it’s time to prioritize and pay off high-interest debt. High-interest debt, such as credit card debt, can quickly spiral out of control if left unchecked. Start by making minimum payments on all your debts to avoid late fees and penalties. Then, allocate any additional funds towards the debt with the highest interest rate.

There are two common debt repayment strategies you can consider: the debt avalanche method and the debt snowball method. The debt avalanche method involves prioritizing debts based on their interest rates, starting with the highest rate. By tackling high-interest debt first, you minimize the overall interest paid. The debt snowball method, on the other hand, involves paying off debts in order of smallest to largest balance. This method provides psychological motivation as you see smaller debts being eliminated quickly, keeping you motivated on your journey.

Choose the method that aligns with your financial goals and personal preferences. Remember, the key is to stay consistent and committed to your debt repayment plan. Celebrate each milestone along the way, as it reinforces your progress and motivates you to keep going.

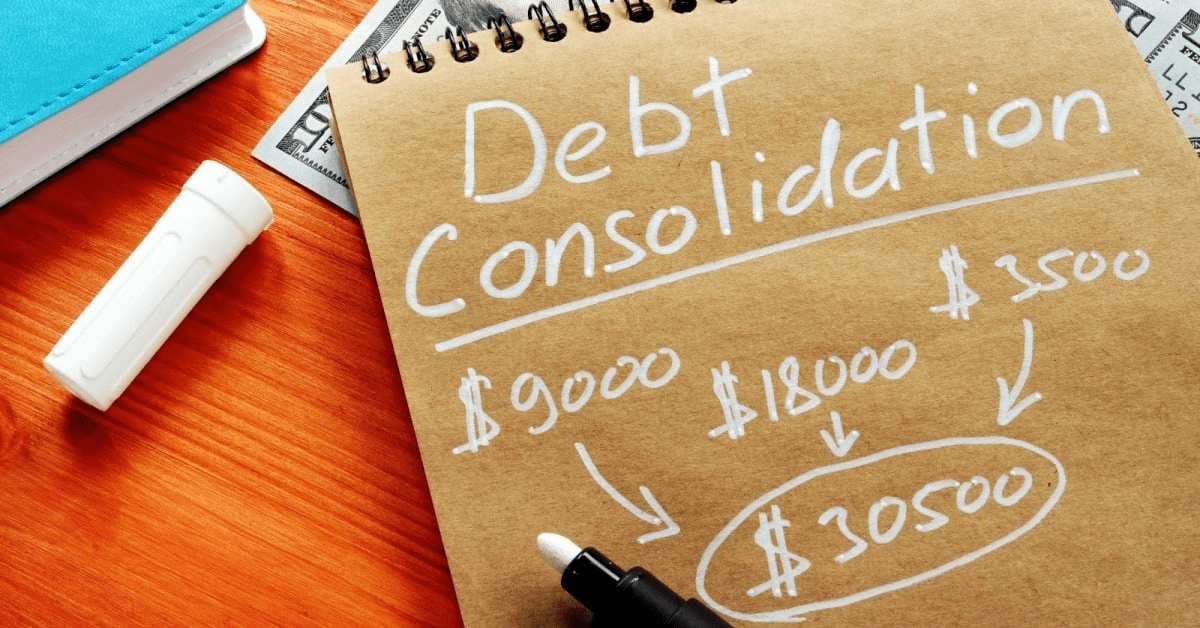

Step 4: Exploring Debt Consolidation Options

Debt consolidation can be a useful strategy to simplify your debt repayment process and potentially lower your interest rates. Debt consolidation involves combining multiple debts into a single loan or credit card with a lower interest rate. This can make it easier to manage your debts and potentially reduce the overall interest paid.

There are several debt consolidation options available, such as balance transfer credit cards, personal loans, or home equity loans. Balance transfer credit cards allow you to transfer high-interest credit card debt to a card with a promotional 0% interest rate for a limited period. Personal loans provide a lump sum to pay off your debts, and home equity loans use your home as collateral to secure a loan with favorable terms.

Before opting for debt consolidation, carefully consider the terms, fees, and impact on your credit score. It’s important to weigh the pros and cons and ensure that debt consolidation aligns with your financial goals and circumstances.

Step 5: Building an Emergency Fund

As you work towards paying off your debts, it’s essential to build an emergency fund to protect yourself from unforeseen expenses. An emergency fund acts as a financial safety net, allowing you to cover unexpected medical bills, car repairs, or job loss without relying on credit cards or loans. Instagram Chat Assistant – $250 a Day

Start by setting a realistic goal for your emergency fund, such as three to six months’ worth of living expenses. Allocate a portion of your income towards your emergency fund until you reach this target. Consider opening a separate bank account specifically for your emergency fund to avoid temptation.

Building an emergency fund requires discipline and consistency. It may take time, but the peace of mind it provides is invaluable. Remember, having an emergency fund in place can prevent you from falling back into debt when unexpected expenses arise.

Step 6: Investing for the Future

Once you have paid off your high-interest debts and built an emergency fund, it’s time to shift your focus towards investing for the future. Investing allows your money to grow over time and provides a path to long-term wealth accumulation. Whether it’s through retirement accounts like 401(k)s or individual investment accounts, investing can help you achieve financial independence and security.

Consider consulting with a financial advisor or doing thorough research before making investment decisions. Diversify your portfolio to spread risk and aim for a balanced approach that aligns with your risk tolerance and financial goals. Remember, investing is a long-term commitment, and patience is key. Stay informed, review your investments periodically, and make adjustments as needed.

Step 7: Maintaining a Debt-Free Lifestyle

Congratulations! You have successfully paid off your debts and taken control of your financial future. However, the journey doesn’t end here. Maintaining a debt-free lifestyle requires ongoing discipline and mindful financial habits.

Continue to live within your means, track your expenses, and stick to your budget. Avoid unnecessary debt by paying for purchases in cash or using a credit card responsibly and paying off the balance in full each month. Cultivate healthy financial habits, such as saving regularly, automating bill payments, and avoiding impulse spending.

Stay vigilant and be prepared to adapt to life’s changes. Unexpected events, such as job loss or medical emergencies, can disrupt your financial stability. By staying proactive, having a contingency plan, and leveraging the financial knowledge you have gained, you can navigate these challenges without falling back into debt.

Additional Resources for Debt Management and Financial Literacy

Ditching debt and achieving financial liberation is a journey that requires continuous learning and improvement. Fortunately, there are numerous resources available to help you along the way. Consider exploring the following:

- Financial literacy courses: Many organizations and institutions offer free or affordable courses on personal finance and debt management. These courses can enhance your knowledge and empower you to make informed financial decisions. Post images on Social media for $200 per day

- Online forums and support groups: Joining online forums and support groups can provide a sense of community and a platform to share experiences, tips, and strategies. Engaging with others who are on a similar journey can be motivating and inspiring.

- Books and publications: There is a wealth of literature available on personal finance, debt management, and investing. Consider reading books by renowned financial experts to gain insights and inspiration.

- Financial advisors: If you feel overwhelmed or need personalized guidance, seeking the help of a financial advisor can be beneficial. A professional can provide tailored advice based on your unique circumstances and goals.

Remember, knowledge is power, and continually educating yourself about personal finance will equip you with the tools and confidence to make sound financial decisions.

Conclusion

Ditching debt and achieving a financially liberated life is an attainable goal for anyone willing to commit to the journey. By understanding the impact of debt, assessing your financial situation, creating a budget, prioritizing debt repayment, exploring debt consolidation options, building an emergency fund, investing for the future, and maintaining a debt-free lifestyle, you can break free from the chains of debt and create a brighter financial future.

Remember, the key is to be patient, persistent, and disciplined. Celebrate each milestone, stay educated, and seek support when needed. With determination and a solid plan, you can embark on a path towards financial freedom and enjoy the peace of mind that comes with being debt-free.

FAQs

Q: How long will it take to become debt-free?

A: The time it takes to become debt-free depends on several factors, such as the amount of debt, your income, and the repayment strategy you adopt. With dedication and a well-executed plan, it’s possible to eliminate debt within a few years. However, each individual’s situation is unique, so it’s important to be patient and stay committed to your debt repayment journey.

Q: Should I prioritize paying off all debts at once or focus on high-interest debts first?

A: While it’s important to make minimum payments on all debts to avoid penalties, it’s generally more effective to prioritize high-interest debts first. By tackling debts with higher interest rates, you minimize the overall interest paid and accelerate your debt repayment journey. However, personal preferences and financial goals may influence your approach, so choose the strategy that aligns best with your circumstances.

Q: Is debt consolidation a good option for me?

A: Debt consolidation can be a useful strategy to simplify debt repayment and potentially lower interest rates. However, it’s important to carefully consider the terms, fees, and impact on your credit score before opting for debt consolidation. Assess your financial goals and circumstances, and weigh the pros and cons to determine if debt consolidation aligns with your needs.

Q: How can I avoid falling back into debt after becoming debt-free?

A: Maintaining a debt-free lifestyle requires ongoing discipline and mindful financial habits. Continue to live within your means, track expenses, and stick to your budget. Cultivate healthy financial habits, such as saving regularly, automating bill payments, and avoiding impulse spending. Stay proactive and be prepared for unexpected events by having a contingency plan and leveraging the financial knowledge you have gained.

National Stats

According to recent statistics, the average household debt in the United States reached $145,000 in 2021. Credit card debt accounted for a significant portion of this debt, with the average American carrying over $5,000 in credit card balances. Student loan debt continues to rise, with the average borrower owing over $37,000. These statistics highlight the pressing need for individuals to take control of their financial situations and work towards a debt-free life.

Start your journey towards financial liberation today. Assess your financial situation, create a budget, and take the first step towards paying off your debts. Remember, every small action brings you closer to a debt-free life and a brighter financial future.