Unlocking Financial Freedom: 11 Proven Methods

to Overcome Debt and Boost Your Income!

Understanding the Impact of Debt on Financial Freedom

Debt can have a significant impact on your financial freedom. It can weigh you down, restrict your choices, and limit your ability to pursue your dreams. Understanding the impact of debt is the first step towards achieving financial freedom. When you carry debt, a portion of your income goes towards paying off interest, which means less money for savings and investments. Additionally, high levels of debt can affect your credit score, making it more challenging to secure favorable loan terms in the future. To truly unlock financial freedom, you need to confront your debt head-on. Start by assessing your current financial situation.

Assessing Your Current Financial Situation

Before you can make a plan to overcome debt and boost your income, you need to have a clear understanding of your current financial situation. This involves gathering all your financial documents, such as bank statements, credit card statements, and loan statements. $850 per week for watching movies on Netflix.

Create a comprehensive list of all your debts, including the outstanding balances, interest rates, and minimum monthly payments. Calculate your monthly income and expenses to determine how much disposable income you have available to allocate towards debt repayment.

By having a complete picture of your finances, you can identify areas where you can cut expenses and free up more money to pay off debt.

Creating a Budget and Tracking Expenses

Creating a budget is an essential step towards financial freedom. It allows you to take control of your money and make informed decisions about spending and saving.

Start by listing all your sources of income, including your salary, any side hustles, and freelance work. Then, track your expenses over a month to get a clear understanding of where your money is going. Categorize your expenses into fixed expenses (such as rent and utilities) and variable expenses (such as groceries and entertainment).

Once you have a clear overview of your income and expenses, you can create a budget that aligns with your financial goals. Allocate a portion of your income towards debt repayment, savings, and investments. Stick to your budget and track your expenses regularly to ensure you stay on track.

Cutting Expenses and Living Frugally

To accelerate your journey towards financial freedom, it’s crucial to cut expenses and live frugally. Look for areas in your budget where you can make small adjustments that will add up over time.

Start by reviewing your variable expenses. Can you find cheaper alternatives for groceries and household items? Can you reduce your entertainment expenses by finding free or low-cost activities?

Consider downsizing your housing or transportation to lower fixed expenses. Explore options for reducing utility bills, such as conserving energy and water.

Living frugally doesn’t mean sacrificing your quality of life; it means being mindful of your spending and prioritizing your financial goals. By cutting expenses, you can free up more money to pay off debt and invest in your future.

Increasing Your Income Through Side Hustles and Freelance Work

If you’re looking to boost your income and accelerate your journey towards financial freedom, consider taking on side hustles or freelance work. These additional sources of income can provide you with the extra funds you need to pay off debt or invest.

Think about your skills, hobbies, and interests. Is there a way to monetize them? Explore freelance platforms or create your own online business. Consider offering services such as writing, graphic design, or consulting.

Additionally, you can look for part-time job opportunities that align with your schedule and interests. Even a few extra hours of work each week can make a significant difference in your financial situation. Article Writers – $250 a day

By increasing your income, you can allocate more money towards debt repayment and savings, bringing you closer to financial freedom.

Investing for Long-Term Financial Growth

While paying off debt is essential, it’s equally important to invest for long-term financial growth. Investing allows your money to work for you and generate passive income.

Educate yourself about different investment options, such as stocks, bonds, real estate, and mutual funds. Consider working with a financial advisor to create a diversified investment portfolio that aligns with your risk tolerance and financial goals.

Investing for the long term requires patience and discipline. Stay informed about market trends but avoid making impulsive decisions based on short-term fluctuations. Regularly review and rebalance your portfolio to ensure it continues to align with your financial objectives.

By investing wisely, you can grow your wealth and create a solid financial foundation for the future.

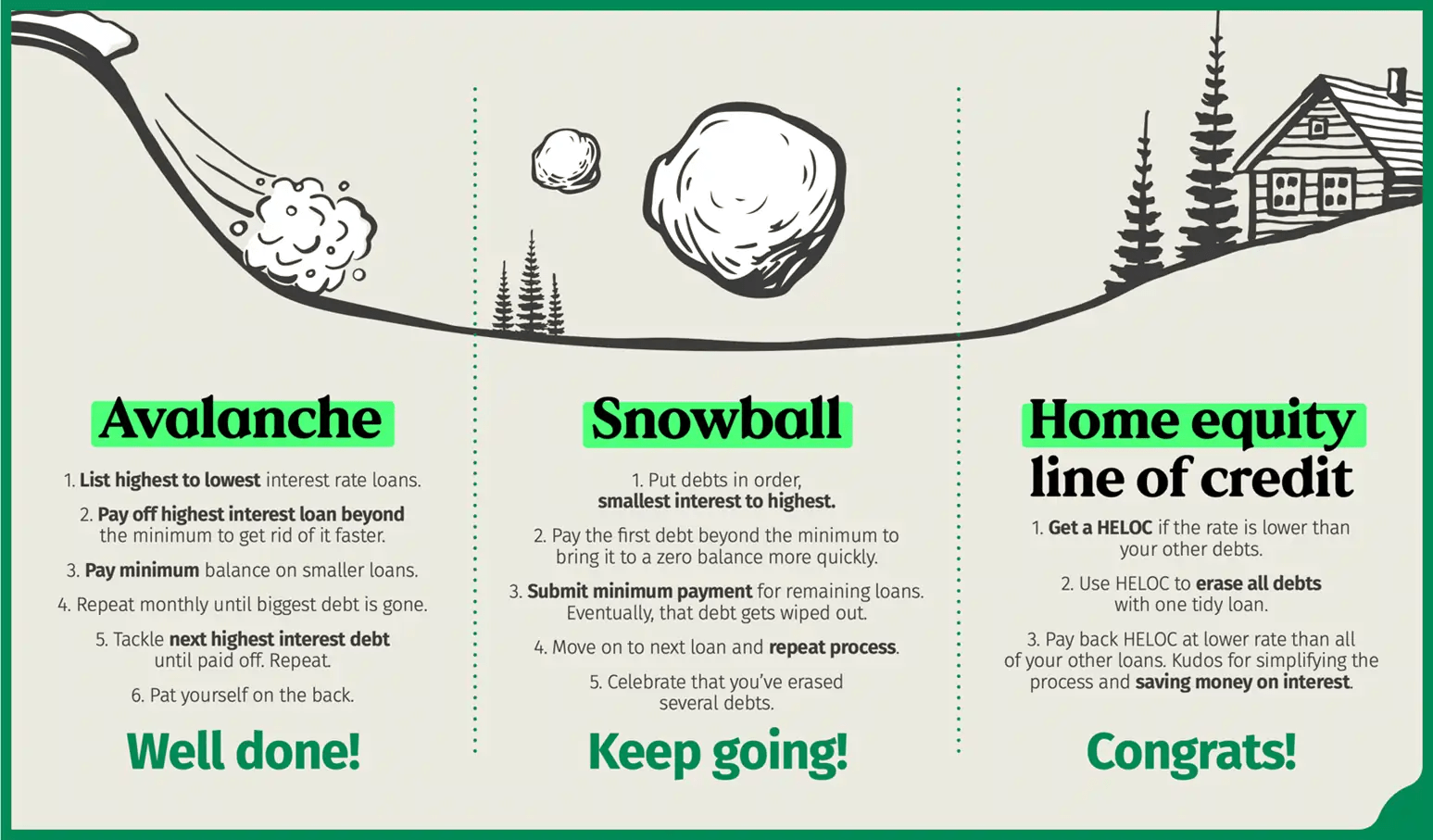

Paying off Debt Strategically with the Debt Snowball or Debt Avalanche Method

To overcome debt effectively, you need a strategy. Two popular methods are the debt snowball and debt avalanche methods.

The debt snowball method involves paying off your smallest debts first while making minimum payments on larger debts. Once the smallest debt is paid off, you roll the payment towards the next smallest debt. This method provides a psychological boost as you see debts being eliminated one by one.

The debt avalanche method, on the other hand, focuses on paying off debts with the highest interest rates first. By targeting high-interest debts, you minimize the amount of interest paid over time, allowing you to become debt-free faster.

Choose the method that best suits your financial situation and personality. The key is to stay committed to the chosen method and maintain consistent payments towards your debts. How to make $1,000 per day on complete auto-pilot 24/7

Negotiating with Creditors and Exploring Debt Consolidation Options

If you’re struggling to keep up with multiple debts or high interest rates, it may be worth exploring debt consolidation options. Debt consolidation involves combining multiple debts into a single loan with a lower interest rate.

Research different debt consolidation options, such as personal loans or balance transfer credit cards. Compare interest rates, fees, and repayment terms to find the best option for your situation.

Additionally, consider negotiating with your creditors to lower interest rates or negotiate a repayment plan that better suits your financial capabilities. Many creditors are willing to work with you if you communicate your situation and show a willingness to repay.

By exploring debt consolidation and negotiating with creditors, you can potentially reduce your overall debt burden and make it more manageable to pay off.

Seeking Professional Help and Considering Bankruptcy as a Last Resort

If you find yourself overwhelmed by debt and unable to make progress despite your best efforts, it may be time to seek professional help. Financial advisors, credit counselors, and bankruptcy attorneys can provide guidance and support in navigating your financial challenges. Instagram Chat Assistant – $250 a Day

A financial advisor can help you create a comprehensive financial plan, including debt repayment strategies and investment options. Credit counselors can negotiate with your creditors on your behalf and provide debt management plans.

Bankruptcy should be considered as a last resort when all other options have been exhausted. Consult with a bankruptcy attorney to understand the implications and determine if it’s the right course of action for your situation.

Remember, seeking professional help is not a sign of failure but rather a proactive step towards finding a solution and achieving financial freedom.

Building an Emergency Fund and Saving for the Future

As you work towards paying off debt and boosting your income, it’s crucial to build an emergency fund and save for the future. An emergency fund provides a safety net in case of unexpected expenses or income disruptions.

Start by setting a goal for your emergency fund, such as three to six months’ worth of living expenses. Automate regular contributions to your emergency fund, even if it’s a small amount at first. Over time, your fund will grow, providing you with peace of mind and financial security.

Simultaneously, prioritize saving for the future. Contribute to retirement accounts such as a 401(k) or IRA to ensure a comfortable retirement. Explore other savings vehicles, such as a high-yield savings account or a brokerage account, to grow your wealth and achieve long-term financial goals.

Celebrating Milestones and Staying Motivated on Your Journey to Financial Freedom

Along your journey to financial freedom, it’s essential to celebrate milestones and stay motivated. Paying off a debt, reaching a savings goal, or achieving a financial milestone deserves recognition. Post images on Social media for $200 per day

Reward yourself for your achievements, but do so in a way that aligns with your financial goals. Treat yourself to a small indulgence, such as a nice dinner or a weekend getaway, but avoid going overboard and undoing your progress.

Stay motivated by visualizing your financial goals and the life you want to live. Create a vision board or write down your goals and review them regularly. Surround yourself with like-minded individuals who can provide support and accountability.

Remember, achieving financial freedom is a journey, not a destination. Stay focused, keep learning, and adapt your strategies as needed. With dedication and perseverance, you can unlock the door to financial freedom.

Conclusion: Taking Control of Your Finances and Achieving Long-Lasting Financial Freedom

Taking control of your finances and achieving long-lasting financial freedom is within your reach. By understanding the impact of debt, assessing your financial situation, creating a budget, cutting expenses, increasing your income, investing wisely, and strategically paying off debt, you can pave the way towards a brighter financial future.

Consider exploring debt consolidation options, seeking professional help if needed, and building an emergency fund to provide a safety net. Stay motivated and celebrate milestones along the way, knowing that every step you take brings you closer to unlocking true financial freedom.

FAQs

Q1: How long does it take to achieve financial freedom?

The timeline to achieve financial freedom varies for each individual and depends on factors such as the amount of debt, income level, and financial discipline. It’s important to stay committed to your financial goals and make consistent progress, even if it takes several years to achieve complete financial freedom.

Q2: Should I focus on paying off debt or saving for the future first?

It’s advisable to strike a balance between paying off debt and saving for the future. While paying off high-interest debt should be a priority to minimize interest payments, it’s also essential to start saving for emergencies and retirement. Consider allocating a portion of your income towards both debt repayment and savings simultaneously.

Q3: How can I stay motivated on my journey to financial freedom?

Staying motivated on your journey to financial freedom can be challenging, especially when faced with setbacks or temptations to overspend. Create a vision board or write down your financial goals to remind yourself of the bigger picture. Surround yourself with supportive individuals who can provide accountability and encouragement. Celebrate milestones along the way to stay motivated and reward yourself for your achievements.

National Stats

According to recent statistics, the average household debt in the United States is $90,460, excluding mortgages. This highlights the widespread issue of debt in our society and the need for effective strategies to overcome it.

Furthermore, a survey conducted by the Federal Reserve revealed that 37% of adults in the United States would not be able to cover an unexpected expense of $400 without borrowing money or selling belongings. This emphasizes the importance of building an emergency fund to provide financial security.

These national stats serve as a reminder that debt is a common challenge faced by many individuals and families. By implementing the proven methods discussed in this article, you can break free from the chains of debt and unlock the path to financial freedom.

Start your journey towards financial freedom today. Assess your current financial situation, create a budget, and implement the strategies outlined in this article. Remember, achieving financial freedom is a marathon, not a sprint. Stay committed, stay motivated, and take control of your finances. You have the power to unlock a brighter financial future.