Invest in Your Future: 8 Money-Saving Tactics

That Build Wealth Over Time!

Introduction: Why it’s important to invest in your future

Investing in your future is one of the most important steps you can take to secure financial stability and build wealth over time. While it may seem daunting, with the right strategies and tactics, you can make your money work for you. By implementing smart money-saving tactics, you can set yourself up for a prosperous future. In this article, we will explore eight effective methods that will help you save money and build wealth over time. How to make $1,000 per day on complete auto-pilot 24/7

Investing in Your Future: Building a Pathway to Financial Freedom

Securing your financial future isn’t about blind luck or a sudden windfall. It’s a deliberate journey paved with smart choices and consistent action. One of the most crucial steps on this path is investing. It might sound intimidating at first, conjuring images of high-stakes stock exchanges and complex financial jargon. But in reality, investing is about empowering yourself to make your money work for you and build wealth over time. It’s about planting seeds today that blossom into a secure and fulfilling future.

The good news is, you don’t need a hefty starting sum or a degree in finance to begin your investment journey. By incorporating smart money-saving tactics and effective wealth-building strategies, you can take control of your financial well-being and unlock the power of compound interest.

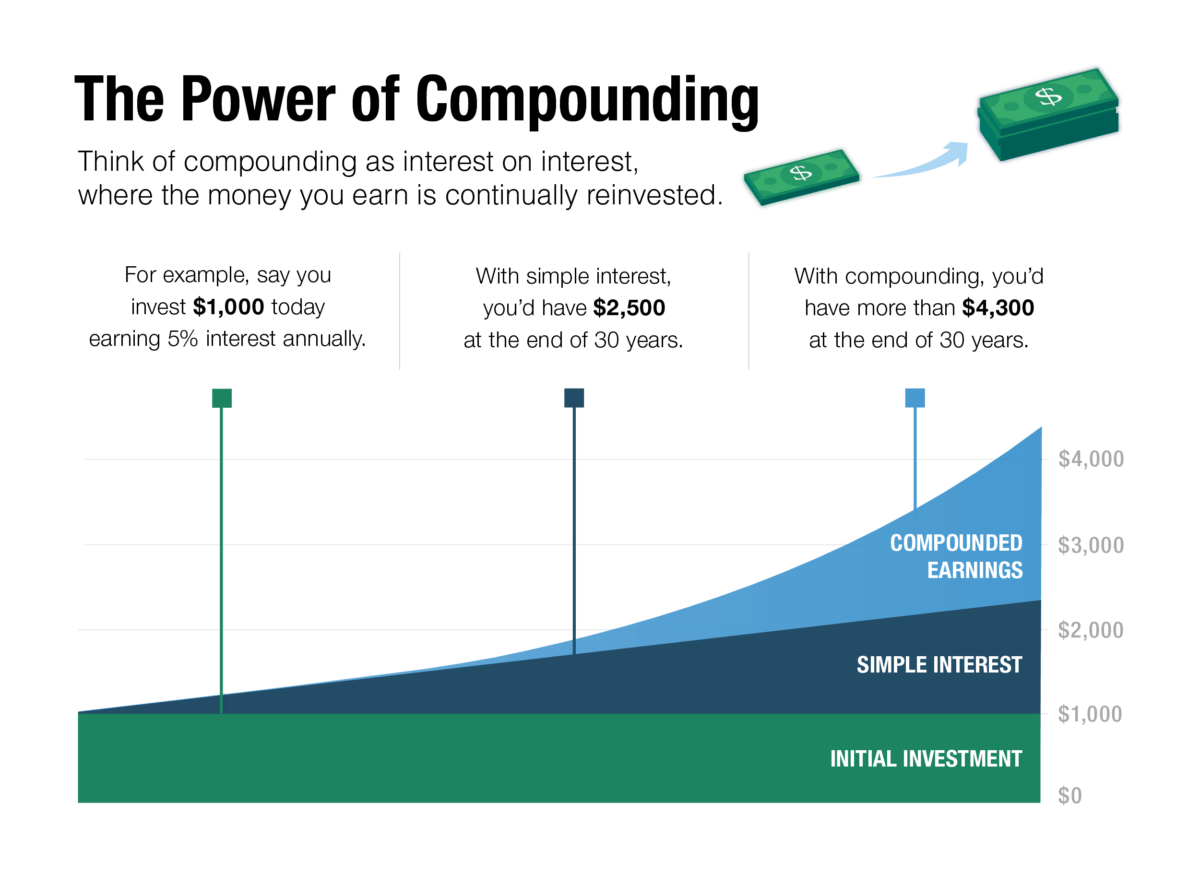

Compound interest is often referred to as the “eighth wonder of the world” for a reason. Imagine a snowball rolling downhill – it starts small but gathers momentum with each revolution, growing exponentially larger. Compound interest works in a similar way. When you invest your money, it earns returns, which are then reinvested and earn returns on those returns as well. Over time, this creates a snowball effect, significantly growing your wealth without requiring constant additional contributions.

This article equips you with eight effective methods to kickstart your wealth-building journey. These strategies are designed to be accessible and actionable, regardless of your current financial situation. By implementing them consistently, you’ll be well on your way to achieving financial stability and fulfilling your long-term financial goals.

Here’s a glimpse of the valuable insights you’ll find within:

- Mastering the art of budgeting: This is the foundation of any successful financial plan. We’ll explore different budgeting techniques to help you track your income and expenses, identify areas for improvement, and free up resources for saving and investing.

- Harnessing the power of automation: Setting up automatic transfers from your checking account to your savings or investment accounts removes the temptation to spend and ensures consistent growth over time.

- Embracing the power of small, regular contributions: You don’t need a significant sum to start investing. Even small, regular contributions can accumulate substantial wealth over time thanks to compound interest.

- Demystifying different investment options: From low-risk savings accounts to diversified investment portfolios, we’ll explore various investment vehicles to suit your risk tolerance and financial goals.

- Understanding the importance of diversification: Don’t put all your eggs in one basket! Diversifying your investments across different asset classes helps mitigate risk and ensures your portfolio is resilient to market fluctuations.

- Living frugally and minimizing unnecessary expenses: While depriving yourself isn’t the aim, making conscious choices to curb unnecessary spending frees up more money for saving and investing.

- Exploring debt repayment strategies: High-interest debt can be a major roadblock to wealth creation. We’ll discuss effective strategies to pay down debt and free up your income for future investments.

- Seeking professional guidance (optional): For those seeking more personalized advice, consulting a financial advisor can be a valuable resource. They can help you assess your risk tolerance, develop a customized investment plan, and navigate the complexities of the financial world.

Remember, building wealth is a marathon, not a sprint. By prioritizing consistent effort and smart financial decisions, you can transform your future and unlock the door to financial freedom. So, let’s embark on this journey together and explore the empowering world of saving, investing, and building a prosperous future for yourself!

The power of compounding: How small savings can grow over time

One of the most powerful tools in wealth-building is the concept of compounding. Compounding refers to the ability of your savings to generate earnings, which are then reinvested and generate even more earnings. By starting early and consistently saving, you allow your money to grow exponentially over time. Even small deposits can have a significant impact when given enough time to compound.

To take advantage of the power of compounding, it is crucial to start saving as early as possible. Make it a habit to set aside a portion of your income each month and put it into a high-yield savings account or investment vehicle. By doing so, you allow your money to work for you, increasing your wealth over time. $25 an Hour Chat on Twitter Job!

Budgeting for wealth: How to create a savings plan

Creating a budget is an essential step in building wealth. A budget helps you track your income and expenses, allowing you to identify areas where you can cut back and save more. Start by listing all your sources of income and categorizing your expenses. Be sure to include any debts or loans you have, as these should be factored into your budget as well.

Once you have a clear picture of your finances, you can determine how much you can realistically save each month. Aim to save at least 20% of your income, but if that is not possible, start with a smaller percentage and gradually increase it as your income grows. Make saving a priority and treat it as a non-negotiable expense. By sticking to your budget and consistently saving, you will be well on your way to building wealth.

Cutting expenses: Strategies for reducing costs and saving money

Reducing expenses is an effective way to save money and build wealth over time. Start by evaluating your monthly bills and identifying areas where you can cut back. Consider negotiating lower rates for your utilities, cable, and internet services. Look for cheaper alternatives for your insurance policies. Additionally, review your subscription services and cancel any that you no longer use or can live without.

Another way to cut costs is by minimizing your discretionary spending. While it’s important to enjoy life, be mindful of unnecessary expenses that can hinder your ability to save. Limit dining out, entertainment expenses, and impulse purchases. Instead, focus on experiences that are both enjoyable and cost-effective, such as exploring local parks or having picnics with friends and family.

Automating savings: Using technology to make saving effortless

In today’s digital age, automating your savings is easier than ever. Take advantage of technology by setting up automatic transfers from your checking account to your savings or investment accounts. By automating your savings, you eliminate the temptation to spend the money before saving it. It also ensures that you consistently save, even when life gets busy. Want To Earn An Extra $2000 Per Month?

Another way to automate your savings is by enrolling in an employer-sponsored retirement plan, such as a 401(k) or IRA. These plans deduct a portion of your paycheck before taxes, allowing your savings to grow tax-deferred until retirement. Take advantage of any employer matching contributions, as this is essentially free money that can significantly boost your savings over time.

Investing in stocks: Understanding the basics and getting started

Investing in stocks is a proven method for building wealth over time. While it may seem intimidating, with a basic understanding of the stock market and a long-term perspective, you can confidently invest in stocks. Start by educating yourself about different investment strategies, risk tolerance, and asset allocation.

To get started, open a brokerage account and set aside a portion of your savings for investments. Consider investing in low-cost index funds or exchange-traded funds (ETFs), which provide diversification and minimize risk. It’s important to remember that investing in stocks involves risks, and it’s essential to do thorough research and consult with a financial advisor if needed.

Real estate investments: Exploring different options and potential returns

Real estate investments can be a lucrative way to build wealth over time. Investing in rental properties or real estate investment trusts (REITs) allows you to generate passive income and potentially benefit from property appreciation. However, real estate investments also come with risks and require careful consideration.

Before investing in real estate, thoroughly research the market and analyze potential returns. Consider factors such as location, rental demand, and property management. If you prefer a more hands-off approach, REITs offer a way to invest in real estate without the need for direct property ownership. Consult with real estate professionals and financial advisors to ensure you make informed investment decisions.

Diversifying your portfolio: The importance of spreading your investments

Diversifying your portfolio is essential for long-term wealth-building. By spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities, you reduce the risk of losing all your savings in a single investment. Diversification allows you to take advantage of different market conditions and potentially earn higher returns. Write Blog Posts $35 An Hour!

To diversify your portfolio, consider investing in mutual funds or exchange-traded funds (ETFs) that offer exposure to various asset classes. Additionally, regularly review your portfolio and rebalance it if needed. Consult with a financial advisor to determine the optimal asset allocation based on your risk tolerance and financial goals.

Retirement planning: Building wealth for a secure future

Retirement planning is crucial for building wealth and ensuring financial security in your later years. Start by determining your retirement goals and estimating how much you will need to save to achieve them. Consider factors such as inflation, healthcare costs, and lifestyle choices.

Take advantage of retirement savings accounts, such as 401(k)s, IRAs, or Roth IRAs. Contribute the maximum amount allowed each year and take advantage of any employer-matching contributions. If you are self-employed, explore options such as a Simplified Employee Pension (SEP) IRA or a Solo 401(k).

Regularly review your retirement plan and adjust your savings and investment strategies as needed. As you near retirement age, gradually shift your investments to more conservative options to protect your savings. Consulting with a financial advisor can provide valuable guidance and ensure you are on track to meet your retirement goals.

Conclusion: Taking action and building financial security

Investing in your future and building wealth requires discipline, patience, and a long-term perspective. By implementing the money-saving tactics discussed in this article, you can take control of your finances and set yourself up for a prosperous future. Start early, create a budget, cut expenses, automate your savings, and diversify your investments. Remember to stay informed, adapt your strategies as needed, and consult with professionals when necessary. Take action today and build your path to financial security and wealth!

Start implementing these money-saving tactics today and take control of your financial future. Remember, the key to building wealth is consistency and long-term planning. Don’t wait any longer – start investing in your future now!