The Digital Age: 10 Proven Strategies to Master

Your Budget and Save Money!

Introduction to the digital age and its impact on personal finances

Welcome to the digital age, where technology has revolutionized the way we live, work, and manage our personal finances. In this fast-paced world, it’s essential to stay ahead of the game and master your budget to save money effectively. With the abundance of digital tools and resources available, it’s never been easier to take control of your finances and achieve your financial goals. In the digital age, we are bombarded with countless opportunities to spend money. From online shopping to subscription services, it’s easy to lose track of your expenses and let your budget spiral out of control. However, with the right strategies, you can navigate this digital landscape and emerge as a savvy saver.

Importance of budgeting in the digital age

Budgeting is the foundation of financial success, and it becomes even more critical in the digital age. With the constant temptation to make impulse purchases and the ease of online transactions, it’s easy to overspend and lose track of your financial goals. However, by creating a budget and sticking to it, you can take control of your money and ensure that every dollar is spent wisely.

A budget allows you to allocate your income to different categories, such as housing, transportation, groceries, and entertainment. By setting limits for each category, you can avoid overspending and make informed decisions about your expenses. It also enables you to save for future goals, whether it’s a dream vacation, a down payment for a house, or retirement. Make $30 Per Photo You Take!

Embracing technology: Budgeting apps and tools

One of the most powerful tools at your disposal in the digital age is budgeting apps and tools. These applications can help you track your expenses, set financial goals, and analyze your spending patterns. By linking your bank accounts and credit cards, these apps automatically categorize your transactions and provide you with valuable insights into your financial habits.

Popular budgeting apps like Mint, YNAB (You Need a Budget), and Personal Capital offer a user-friendly interface and robust features to help you stay on top of your budget. They provide real-time updates on your spending, send alerts for bill payments, and even offer personalized suggestions to optimize your budget. With these apps, you can have your entire financial life at your fingertips.

Automating your finances for savings and efficiency

Another strategy to master your budget in the digital age is to automate your finances. With online banking and automatic bill payments, you can streamline your financial transactions and save time. By setting up automatic transfers to your savings account or investment portfolio, you can ensure that a portion of your income is saved or invested without even thinking about it.

Automation not only helps you save money but also improves your financial discipline. By removing the need for manual transactions, you reduce the risk of late payments and fees. Moreover, it allows you to take advantage of high-yield savings accounts and investment opportunities that can grow your wealth over time.

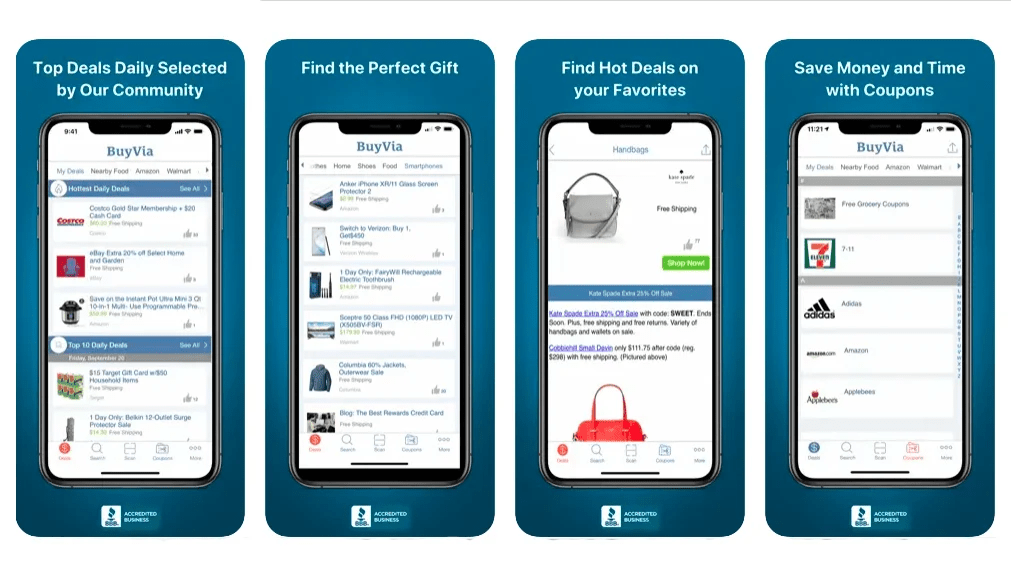

Comparison shopping and using price tracking tools

In the digital age, it’s easier than ever to find the best deals on products and services. Comparison shopping websites and apps enable you to compare prices across multiple retailers to ensure that you’re getting the best value for your money. By doing a quick search before making a purchase, you can potentially save a significant amount of money. Article Writers Can Make $250 Per Day!

Price tracking tools are another valuable resource in the digital age. These tools monitor the prices of specific products and notify you when there is a price drop. By leveraging these tools, you can time your purchases to get the best possible price, especially for big-ticket items. Saving money has never been more effortless.

Utilizing cashback and reward programs

In the digital age, cashback and reward programs have become increasingly popular. These programs allow you to earn points or cashback on your purchases, which can then be redeemed for discounts, gift cards, or even cash. By utilizing these programs, you can effectively reduce your expenses and save money in the process.

There are various types of cashback and reward programs available, ranging from credit card rewards to online shopping portals. Credit cards with cashback rewards offer a percentage back on your purchases, allowing you to earn money while you spend. Online shopping portals, on the other hand, offer cashback or rewards for shopping through their platform. By being mindful of these programs, you can make every purchase count.

Cutting unnecessary expenses through digital subscriptions and memberships

In the digital age, it’s easy to get caught up in the allure of digital subscriptions and memberships. From streaming services to monthly subscription boxes, these recurring expenses can quickly add up and strain your budget. To master your budget and save money, it’s essential to evaluate your subscriptions and memberships regularly.

Take a moment to review all your digital subscriptions and memberships. Determine which ones truly add value to your life and cancel the ones that no longer serve a purpose. By cutting back on unnecessary expenses, you can free up more money to allocate towards your financial goals.

Managing debt in the digital age

Debt can be a significant obstacle to financial freedom, and managing it becomes even more crucial in the digital age. With easy access to credit cards and online loans, it’s essential to approach debt with caution and develop a plan to pay it off effectively.

Start by organizing your debt and understanding the interest rates and terms of each loan or credit card. Consider consolidating high-interest debt into a lower-interest loan or credit card to reduce interest payments. Create a repayment plan that fits your budget and stick to it. By actively managing your debt, you can save money on interest payments and work towards becoming debt-free.

Investing and growing your savings in the digital age

In the digital age, investing has become more accessible to the average individual. Online investment platforms and robo-advisors offer a user-friendly interface and low-cost investment options. By allocating a portion of your savings towards investments, you can grow your wealth and achieve your long-term financial goals.

Before you start investing, it’s essential to educate yourself about different investment options and assess your risk tolerance. Consider working with a financial advisor or using robo-advisors to guide your investment decisions. By investing wisely, you can take advantage of compounding returns and build a solid financial foundation for the future. Make $950/Week Posting Premade Videos On YouTube!

Protecting your finances in the digital age: Cybersecurity and fraud prevention

While the digital age brings convenience and opportunities, it also poses risks to your financial security. Cybersecurity threats and fraud have become more prevalent, making it crucial to protect your finances in the digital space.

To safeguard your finances, it’s essential to practice good cybersecurity habits. Use strong and unique passwords for your online accounts and enable two-factor authentication whenever possible. Be cautious of phishing emails and suspicious websites that may attempt to steal your personal information. Regularly monitor your bank accounts and credit reports for any unauthorized activity.

Conclusion: Thriving in the digital age while saving money

In conclusion, the digital age offers numerous opportunities to master your budget and save money effectively. By embracing technology, automating your finances, utilizing cashback and reward programs, cutting unnecessary expenses, managing debt, investing wisely, and protecting your finances, you can thrive in this digital landscape while achieving your financial goals. Take control of your financial future today and start making the most of the digital age.

Take charge of your finances in the digital age and start saving money today! Explore budgeting apps, automate your finances, and utilize cashback and reward programs. Cut unnecessary expenses, manage your debt, invest wisely, and protect your finances. With these proven strategies, you can master your budget and thrive in the digital age while saving money. Start your journey towards financial freedom now!