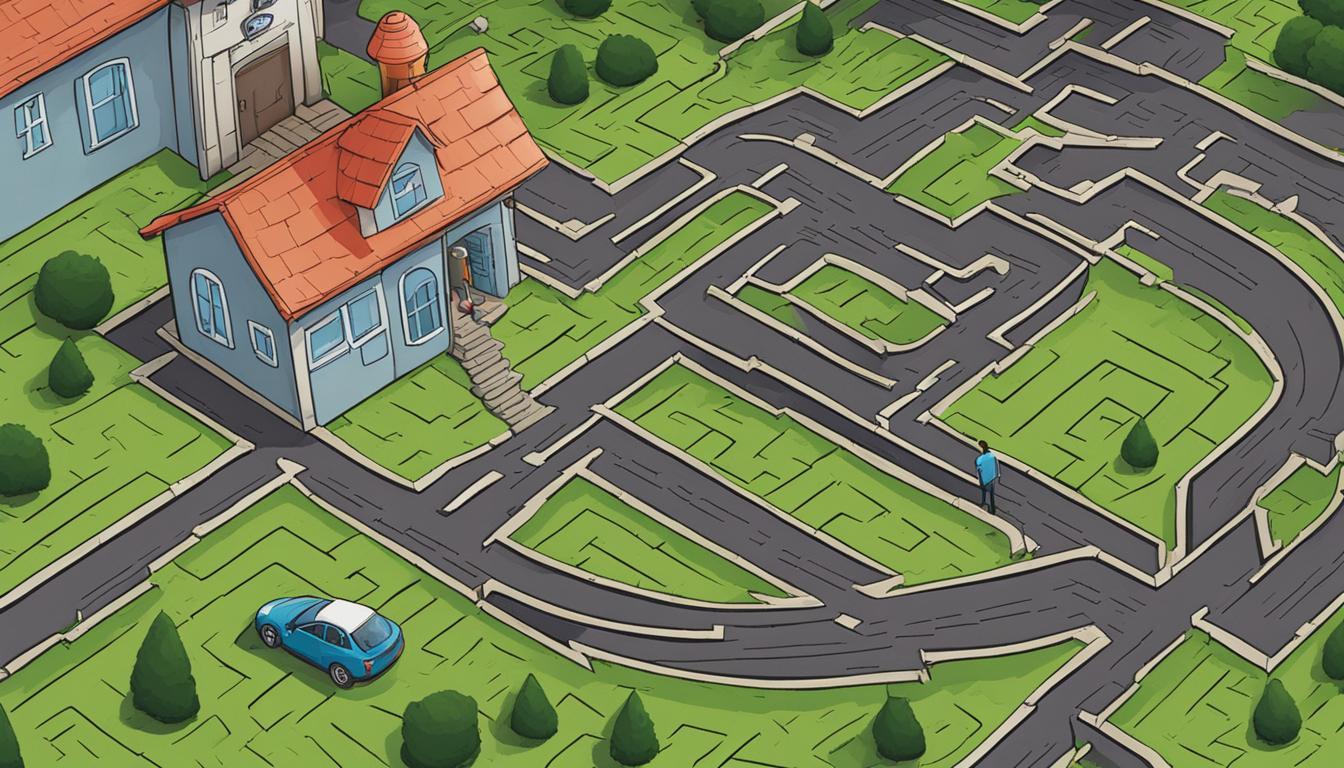

Navigating the Maze: Tips for Car Insurance Shopping

and Securing the Optimal Policy!

Did you know that car insurance rates can vary by as much as 50% for the same coverage? That’s right, choosing the right auto insurance policy is not only essential for protecting yourself on the road, but it can also save you a significant amount of money. With so many options and factors to consider, navigating the world of car insurance shopping can feel like a daunting task.

But fear not! In this comprehensive guide, we’ll provide you with expert tips and tricks to help you navigate the maze of car insurance shopping. From understanding the basics of car insurance to comparing quotes, identifying your coverage needs, and maximizing savings, we’ll equip you with the knowledge to secure the optimal policy that suits your needs and provides the best coverage. $220/day – Shopify Assistant Job

Key Takeaways:

- Car insurance rates can vary significantly, so it’s crucial to shop around for the best policy that meets your needs and budget.

- Understanding the basics of car insurance, including different types of coverage and factors that affect premiums, is essential before diving into the shopping process.

- Comparing quotes from different providers allows you to evaluate prices, coverage options, and discounts to ensure you’re getting the best deal possible.

- Assessing your coverage needs is vital to determine the right amount of protection for your unique circumstances.

- By employing various strategies such as bundling policies and taking advantage of discounts, you can maximize your car insurance savings without compromising on coverage.

Understanding Car Insurance Basics

Before diving into the car insurance shopping process, it’s essential to have a solid understanding of the basics. Educating yourself on the different types of coverage, factors that influence your premiums, and what to consider when choosing a policy will help ensure that you obtain the right level of protection for your needs.

Car insurance coverage is categorized into several types, each serving a specific purpose. Some common types include:

- Liability coverage: Provides financial protection if you’re responsible for causing an accident that results in injury or property damage to others. It typically includes bodily injury liability and property damage liability.

- Collision coverage: Covers the costs of repairing or replacing your vehicle if it sustains damage from a collision, regardless of fault.

- Comprehensive coverage: Offers protection against non-collision incidents, such as theft, vandalism, natural disasters, and falling objects.

- Uninsured/underinsured motorist coverage: Steps in to cover your expenses if you’re involved in an accident with a driver who has little or no insurance.

Now, let’s discuss the factors that can impact your car insurance premiums. Insurers consider various aspects to determine the cost of your policy, including:

- Driving record: A history of accidents or traffic violations may lead to higher premiums, while a clean driving record can result in lower rates.

- Age and gender: Younger, less experienced drivers and male drivers typically pay more for insurance.

- Location: Living in an area with high rates of accidents or vehicle theft may increase your premiums.

- Type of vehicle: Expensive or high-performance vehicles often come with higher insurance costs.

When choosing a car insurance policy, it’s crucial to consider the following factors:

- Policy limits: Determine the maximum amount your insurance provider will pay for a claim. Higher limits offer increased protection but may come with higher premiums.

- Deductible: This is the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums but means you’ll have to pay more in the event of a claim.

- Additional coverage options: Some insurers offer extras like roadside assistance, rental car coverage, or new car replacement. Consider your needs and budget before adding these options.

Understanding car insurance basics is the foundation for making informed decisions about your coverage. Armed with this knowledge, you’ll be better equipped to choose a policy that provides the right level of protection while meeting your budgetary constraints.

Comparing Car Insurance Quotes

One of the most crucial steps in your car insurance shopping journey is comparing quotes from different providers. By doing so, you can effectively evaluate prices, coverage options, and potential discounts, ensuring that you secure the best deal possible for your needs.

When comparing car insurance quotes, remember to consider both the cost and the coverage you will receive. While it’s natural to be drawn to the lowest price, it’s equally important to examine what the policy includes and whether it aligns with your requirements.

Keep these car insurance shopping tips in mind as you compare quotes:

- Compare similar coverage levels: Ensure that you’re evaluating quotes for the same types and amounts of coverage. This will help you make an accurate cost comparison and avoid any surprises later on.

- Review deductible amounts: The deductible is the amount you’ll pay out of pocket before your insurance coverage kicks in. Consider how different deductible amounts affect your premium and think about what you can afford in the event of an accident.

- Look for additional benefits: Some car insurance policies offer additional benefits or perks, such as roadside assistance or accident forgiveness. Assess these extras and determine their value to you.

- Take note of discounts: Discounts can significantly lower your car insurance premiums. Look for discounts related to your driving history, vehicle safety features, or bundling policies with the same insurance provider.

By comparing car insurance quotes thoroughly and considering the key factors mentioned above, you can make an informed decision that ensures both cost-effectiveness and adequate coverage.

Get Quotes from Multiple Providers

When comparing car insurance quotes, it’s essential to obtain them from multiple providers. This enables you to see the range of prices and coverage options available to you. Don’t settle for the first quote you receive – take the time to shop around, explore your options, and gather information from reputable companies.

Remember, finding the right car insurance policy requires careful consideration and evaluation. Take advantage of online resources and tools that can help simplify the comparison process. By dedicating time and effort to compare quotes, you can feel confident in your decision and secure the car insurance policy that meets your needs.

Identifying Your Coverage Needs

When it comes to car insurance, one size does not fit all. Your coverage needs are unique, and finding the optimal auto insurance policy requires careful assessment. Don’t settle for inadequate coverage or overpaying for services you don’t need. Follow these car insurance shopping tips to find the best auto insurance for your specific circumstances. Post images on Social media for $200 per day

Assessing Your Insurance Needs

To determine the right amount of coverage, start by evaluating your personal circumstances. Consider factors such as:

- Your driving habits and mileage

- The value and age of your vehicle

- Your financial situation and assets

- Any additional drivers in your household

By understanding your unique risk profile, you can make informed decisions about the level of coverage you need.

Types of Coverage

Next, familiarize yourself with the different types of car insurance coverage available. The most common types include:

- Liability Coverage: This covers bodily injury and property damage you may cause to others in an accident.

- Collision Coverage: Pays for damages to your vehicle in the event of a collision.

- Comprehensive Coverage: Provides protection against non-collision-related damages, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Offers financial protection if you’re involved in an accident with a driver who lacks sufficient insurance coverage.

Evaluating Coverage Limits

Once you understand the different types of coverage, it’s important to evaluate the coverage limits that come with each policy. Coverage limits determine the maximum amount of money your insurance company will pay for a covered claim. As you assess your coverage needs, consider factors such as:

- The cost of medical expenses and auto repairs in your area

- Your financial ability to pay out-of-pocket for damages beyond your coverage limits

- The value of your assets that could be at risk in a lawsuit

Special Considerations

Depending on your circumstances, there may be additional coverage options to consider. These include:

- Rental Car Reimbursement: Provides coverage for a rental car if your vehicle is being repaired after an accident.

- Roadside Assistance: Offers services such as towing, fuel delivery, and lockout assistance.

- GAP Insurance: This covers the difference between your car’s actual cash value and what you owe on an auto loan or lease.

Taking the time to identify your coverage needs will ensure you find the best auto insurance policy that provides adequate protection without unnecessary costs. Remember, if you have any doubts or need further guidance, don’t hesitate to consult with an insurance professional.

|

Coverage Type |

Description |

|

Liability Coverage |

Covers bodily injury and property damage you may cause to others in an accident. |

|

Collision Coverage |

Pays for damages to your vehicle in the event of a collision. |

|

Comprehensive Coverage |

Provides protection against non-collision-related damages, such as theft, vandalism, or natural disasters. |

|

Personal Injury Protection (PIP) |

Covers medical expenses and lost wages for you and your passengers, regardless of fault. |

|

Uninsured/Underinsured Motorist Coverage |

Offers financial protection if you’re involved in an accident with a driver who lacks sufficient insurance coverage. |

Maximizing Car Insurance Savings

Saving money on car insurance is always a bonus. In this section, we’ll share top tips and strategies to help you reduce your premiums without compromising on coverage. From bundling policies to taking advantage of discounts, you’ll uncover ways to maximize your savings. Want To Earn An Extra $2000 Per Month?

1. Bundle and save: Many insurance providers offer discounts when you bundle multiple policies, such as car and home insurance. Take advantage of these opportunities to lower your overall insurance costs.

2. Increase your deductibles: By opting for a higher deductible, you can lower your monthly premiums. Just make sure you have enough savings to cover the deductible in case of an accident or damage.

3. Maintain a good driving record: Insurance providers reward safe drivers with lower rates. Avoid traffic violations and accidents to keep your premiums in check.

4. Install safety features: Equipping your vehicle with safety features like anti-theft devices, airbags, and advanced driver assistance systems (ADAS) may qualify you for insurance discounts.

5. Take advantage of discounts: Many insurance companies offer a variety of discounts based on factors such as your age, profession, or membership in certain organizations. Be sure to inquire about available discounts to maximize your savings.

Keep in mind that insurance discounts can vary between providers, so it’s worth shopping around and comparing quotes to find the best deal.

6. Drive less, save more: If you have a low annual mileage or use alternative transportation methods, you may qualify for low-mileage discounts. Be sure to inform your insurer about your driving habits to potentially reduce your premiums.

7. Consider usage-based insurance: Some insurance companies offer usage-based policies where your premiums are based on your driving habits. By driving safely and demonstrating responsible behavior on the road, you may be eligible for significant savings.

8. Review your coverage regularly: As your circumstances change, your insurance needs may evolve as well. Regularly review your policy to ensure you’re not paying for coverage you no longer require, helping you save money in the long run.

Top Tip:

When shopping for car insurance, it’s essential to compare quotes from different providers to find the best rates and coverage for your needs. Don’t be afraid to ask questions and explore all available options.

|

Insurance Provider |

Discounts Offered |

|

ABC Insurance |

Multi-policy, safe driver |

|

XYZ Insurance |

Low mileage, good student |

|

123 Insurance |

Usage-based, military discount |

Securely Purchasing Your Optimal Policy

Congratulations! You’ve done your research, compared quotes, and finally found the car insurance policy that meets all your needs. Now, it’s time to make the purchase and secure your optimal coverage. In this section, we’ll guide you through the steps to ensure a seamless and secure purchasing process.

Gather the Necessary Information

Before you begin the purchasing process, gather all the necessary information that will be required by the insurer. This typically includes your personal details, vehicle information, driving history, and any additional documents requested by the insurer. By having everything prepared in advance, you can save time and avoid any potential delays.

Contact the Insurance Provider

Once you have all your information ready, it’s time to contact the insurance provider. Most companies offer multiple channels for purchasing policies, such as phone, online, or in-person. Choose the method that suits you best and reach out to their customer service team. They will guide you through the next steps and provide you with any additional information or clarifications you may need.

Pro Tip: When contacting the insurance provider, consider asking about any ongoing promotions, discounts, or package deals that may be available. This can help you further optimize your policy and potentially save some extra money. $28.50/hr To Write On Facebook

Review the Policy Terms

As with any significant purchase, it’s important to carefully review the policy terms and conditions before making the final decision. Take your time to read through the policy document provided by the insurer. Pay close attention to the coverage details, exclusions, deductibles, limits, and any other important clauses. If you have any questions or concerns, don’t hesitate to reach out to the insurer for clarification.

Review and Confirm the Policy Details

Once you are satisfied with the policy terms, it’s time to review and confirm the policy details. Double-check all the information provided to ensure accuracy. Make sure your personal details, vehicle information, coverage limits, and any additional riders or endorsements are correctly listed. This step will ensure that you purchase the policy that exactly matches your requirements.

Make the Payment

Now that you’ve reviewed and confirmed the policy details, it’s time to make the payment. Follow the instructions provided by the insurer to complete the transaction securely. Opt for a payment method that suits you best, whether it’s online, bank transfer, or any other option offered by the insurer. Be sure to keep a record of the payment confirmation for future reference.

Review the Confirmation Documents

After completing the payment, the insurer will typically send you confirmation documents. Take the time to carefully review these documents and ensure that all the details are accurate. Keep these documents in a safe place as proof of your coverage, and make sure to file them for easy access in case you need to make a claim or refer to the policy in the future.

Congratulations! You have successfully purchased your optimal car insurance policy. Now, you can drive with confidence, knowing that you have the right coverage in place.

Conclusion

After reading our comprehensive guide, you are now equipped with expert tips and tricks for car insurance shopping and securing the optimal policy. Navigating the maze of options and finding the best auto insurance coverage for your needs can be overwhelming, but with our guidance, you can make informed decisions to protect yourself on the road.

Remember, settling for less when it comes to car insurance is not an option. By following our tips and recommendations, you can ensure that you have the right level of coverage without overpaying. Whether you’re a new driver or an experienced one, the key is understanding your coverage needs and comparing quotes from different providers.

Maximizing your car insurance savings is also crucial, and we’ve shared top strategies to help you reduce your premiums without compromising on coverage. From bundling policies to taking advantage of discounts, every step counts in securing a policy that provides both protection and financial peace of mind.

So don’t wait any longer to put these tips into action. Start applying our expert advice today and embark on the journey to finding the optimal car insurance policy that suits your individual needs. Remember, your safety on the road matters, and having the right coverage can make all the difference. Happy car insurance shopping!

FAQ

How can I navigate the maze of car insurance shopping?

Navigating the world of car insurance shopping can be overwhelming, but with our expert tips and tricks, you’ll be able to navigate the maze with ease. We’ll guide you through the process step by step, ensuring you find the optimal policy that suits your needs and provides the best coverage.

What are the basics of car insurance that I need to understand?

Before you start shopping for car insurance, it’s important to understand the basics. We’ll explain the different types of coverage available, factors that can affect your premiums, and what to look for in a policy to ensure you have the right level of protection.

How do I compare car insurance quotes effectively?

Comparing car insurance quotes is an essential part of the shopping process. We’ll show you how to effectively compare prices, coverage options, and discounts from different providers, so you can make an informed decision and get the best deal possible.

How do I identify my coverage needs?

Every driver’s coverage needs are unique. In this section, we’ll help you assess your insurance needs and guide you through determining the right amount of coverage for your specific circumstances. This way, you can avoid inadequate coverage or overpaying for services you don’t need.

What are some tips for maximizing car insurance savings?

Saving money on car insurance is always a plus. We’ll share top tips and strategies to help you maximize your savings without compromising on coverage. From bundling policies to taking advantage of available discounts, you’ll discover ways to reduce your premiums and keep more money in your pocket.

How can I securely purchase my optimal car insurance policy?

Once you’ve found the perfect car insurance policy, it’s important to make a secure purchase. We’ll walk you through the steps to ensure a seamless and confident buying process, giving you peace of mind knowing you’re protected on the road.

What can I expect from following your car insurance shopping tips?

By following our expert tips for car insurance shopping and securing the optimal policy, you’ll be equipped with the knowledge and confidence to find the best auto insurance coverage for your needs. Don’t settle for less – follow our guidance and enjoy peace of mind on the road.