Navigating Your Largest Purchase: A Comprehensive

Guide to Purchasing a New House!

Introduction: Importance of a comprehensive guide to purchasing a new house

Purchasing a new house is one of the most significant decisions you will ever make. It is more than just a financial investment; it is a place where you will create lasting memories and build your future. However, the process of buying a house can be overwhelming and complex. That’s why having a comprehensive guide is essential to navigate through this journey smoothly. This guide will provide you with the necessary information and steps to ensure you make an informed decision when purchasing your dream home. How to make $1,000 per day on complete auto-pilot 24/7

Understanding your needs and preferences

Before embarking on your house-hunting journey, it is crucial to understand your needs and preferences. Start by making a list of the features and amenities that are important to you. Consider factors such as the number of bedrooms and bathrooms, the size of the yard, the location, and the proximity to schools and amenities. This will help you narrow down your search and focus on properties that meet your criteria.

Additionally, think about your long-term plans. Are you planning to expand your family? Do you work from home and need a dedicated office space? Anticipating your future needs will ensure that the house you choose can accommodate your evolving lifestyle.

Setting a budget for your new house

Determining your budget is a crucial step in the house-buying process. Start by assessing your financial situation, including your income, savings, and any existing debts. This will give you an idea of how much you can afford to spend on a new house. Remember to consider additional costs such as property taxes, insurance, and maintenance expenses.

It is also advisable to get pre-approved for a mortgage before starting your search. This will give you a clear understanding of how much you can borrow from a lender. Having a budget in mind will help you narrow down your options and prevent you from falling in love with a house that is beyond your means.

Researching the real estate market

Once you have a clear understanding of your needs and budget, it’s time to research the real estate market. Start by exploring different neighborhoods and areas that align with your preferences. Look for information on property values, market trends, and the overall desirability of the neighborhood.

Online real estate platforms and local real estate agents can be valuable resources for gathering information about the housing market. Pay attention to factors such as the average selling price, the number of days properties stay on the market, and any upcoming developments or infrastructure projects that could impact property values.

By conducting thorough research, you will be equipped with the knowledge needed to make informed decisions during the house-hunting process.

Finding a reliable real estate agent

A reliable and experienced real estate agent can be your greatest asset when purchasing a new house. They have the knowledge, expertise, and network to help you find the perfect home that meets your requirements.

Start by asking for recommendations from friends, family, or colleagues who have recently purchased a house. Look for an agent who specializes in the neighborhood or area you are interested in. Meet with a few agents and ask them about their experience, track record, and approach to helping buyers.

A good real estate agent will listen to your needs, provide valuable insights, and guide you through the entire process. They will help you find suitable properties, negotiate the purchase price, review contracts, and ensure a smooth closing.

Assessing potential neighborhoods

When buying a house, the neighborhood plays a significant role in your overall happiness and quality of life. Take the time to visit potential neighborhoods and get a feel for the community. Consider factors such as safety, schools, amenities, proximity to your workplace, and the overall ambiance.

Talk to neighbors, visit local shops and restaurants, and explore the recreational facilities in the area. Pay attention to the condition of the surrounding properties, the cleanliness of the streets, and the general level of maintenance. These factors will give you a good indication of the neighborhood’s desirability and long-term value.

Remember that what may be an ideal neighborhood for someone else may not necessarily be the right fit for you. Trust your instincts and choose a neighborhood that aligns with your lifestyle and preferences.

Exploring different types of houses and their features

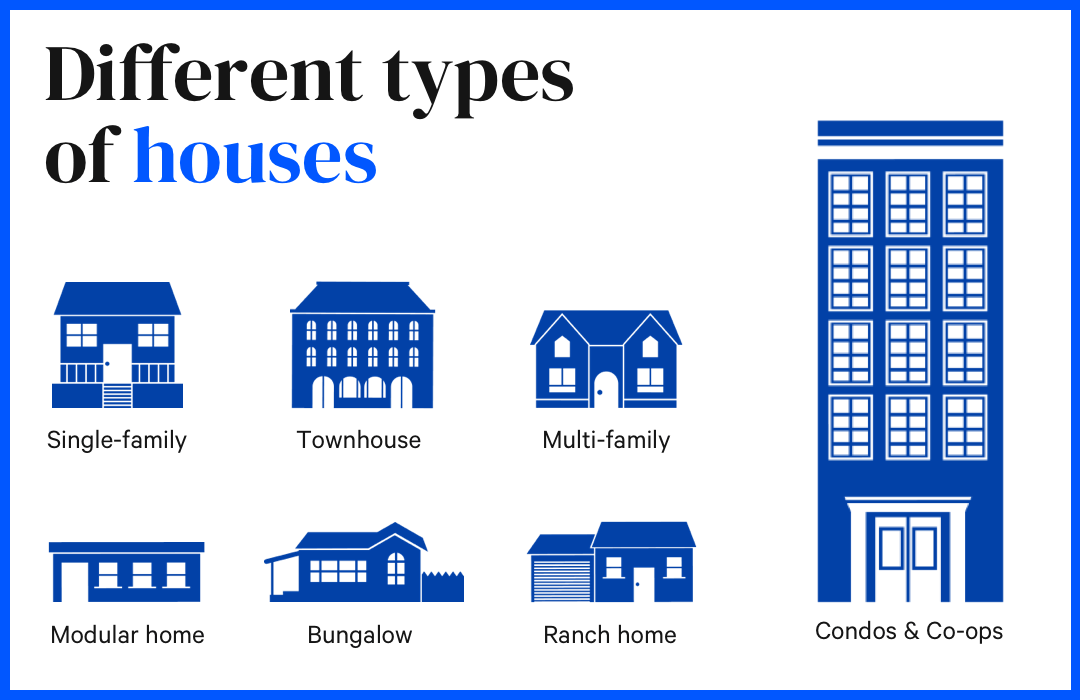

The next step in purchasing a new house is to explore the different types of houses available in the market. From single-family homes to townhouses, condos, and apartments, each type has its own advantages and considerations.

Consider factors such as the size, layout, and design of the house. Think about your preferences for architectural style, the number of floors, and the presence of specific features such as a backyard, a pool, or a garage. Keep in mind that the type of house you choose will also impact your maintenance responsibilities and potential resale value. Customer Support Chat Job: $25/hr

Visit open houses and take virtual tours to get a better understanding of the various types of houses and their unique features. This will help you determine which type of house best suits your needs and preferences.

Evaluating the condition of a house

When you find a house that meets your criteria, it is essential to evaluate its condition thoroughly. This will help you identify any potential issues or repairs that may affect your decision to purchase.

Consider hiring a professional home inspector who can conduct a thorough examination of the property. They will assess the structural integrity, electrical and plumbing systems, roof condition, and overall maintenance of the house. The inspector will provide you with a detailed report highlighting any areas of concern.

Use this information to make an informed decision. If significant issues are identified, you may negotiate repairs or a reduction in the purchase price. Remember that a house in good condition will save you money on repairs and maintenance in the long run.

Understanding the home buying process

Once you have found the perfect house and are ready to make an offer, it’s important to understand the home-buying process. Familiarize yourself with the necessary paperwork and legal procedures involved in purchasing a property.

Work closely with your real estate agent to draft a purchase agreement that outlines the terms and conditions of the sale. This document will include details such as the purchase price, financing contingencies, inspection contingencies, and the closing date.

Ensure that you review the purchase agreement carefully and seek legal advice if needed. Your real estate agent will guide you through the process and ensure that all necessary steps are taken to protect your interests.

Financing options for purchasing a new house

Financing your new house is a crucial step in the home-buying process. There are various financing options available, and it’s important to explore them to find the best fit for your financial situation.

Start by meeting with different lenders and discussing your options. Consider factors such as interest rates, loan terms, and the down payment required. Compare offers from multiple lenders to ensure you secure the most favorable terms.

Additionally, consider getting pre-approved for a mortgage before making an offer on a house. This will strengthen your position as a buyer and show sellers that you are serious about the purchase.

Negotiating the purchase price

Once you have found your dream house, it’s time to negotiate the purchase price. This is where your real estate agent’s expertise comes into play. They will help you determine a fair offer based on market conditions, comparable sales, and the condition of the property. $950/week posting premade videos on YouTube

Keep in mind that negotiation is a give-and-take process. Be prepared to compromise and consider factors such as the seller’s motivation, the length of time the property has been on the market, and any repairs or updates needed.

Conducting a home inspection

Before finalizing the purchase, it is essential to conduct a home inspection. This will give you a comprehensive understanding of the property’s condition and any potential issues that may have been overlooked.

Hire a professional home inspector who will assess the structural integrity, electrical systems, plumbing, and other crucial components of the house. Review the inspection report carefully and discuss any concerns with your real estate agent.

If significant issues are identified, you may negotiate repairs or a reduction in the purchase price. This step ensures that you are making an informed decision and protects your investment.

Reviewing the purchase agreement and closing the deal

Once the negotiations are complete and all contingencies have been satisfied, it’s time to review the final purchase agreement and proceed with the closing. Work closely with your real estate agent and attorney to ensure that all necessary paperwork is in order.

Review the purchase agreement carefully and seek clarification on any terms or conditions that you do not understand. Ensure that you have a clear understanding of the closing costs, including legal fees, title insurance, and property taxes.

On the closing day, sign the necessary documents and transfer the funds required to complete the purchase. Congratulations, you are now a homeowner!

Moving into your new house

Now that you have closed the deal and obtained the keys to your new house, it’s time to plan your move. Create a checklist of tasks such as packing, hiring movers, and updating your address with relevant organizations.

Consider hiring professional movers to ensure a smooth and efficient move. Pack your belongings systematically and label boxes to make unpacking easier. Take the time to settle into your new home and make it your own.

Maintaining and improving your new house

Owning a house comes with responsibilities, including regular maintenance and potential improvements. Create a maintenance schedule to ensure that your house remains in good condition. $850 per week for watching movies on Netflix

Regularly inspect and clean gutters, change air filters, and service your HVAC system. Stay on top of repairs and address any issues promptly to prevent further damage. Consider investing in upgrades that will increase the value and enjoyment of your home.

Remember that your house is an investment, and taking care of it will ensure its long-term value.

National Stats

In the United States, homeownership rates vary across states and regions. According to the latest data from the U.S. Census Bureau, the national homeownership rate stands at 64.0% as of the first quarter of 2021. This represents a slight increase from previous years.

The highest homeownership rates are found in the Midwest and the South, while the West and the Northeast have lower rates. Factors such as affordability, job opportunities, and population density contribute to these regional differences.

FAQs

Q: How much should I budget for a new house?

A: The budget for a new house depends on various factors such as your income, savings, and desired location. It is advisable to consult with a financial advisor or mortgage lender to determine an appropriate budget based on your financial situation.

Q: Should I hire a real estate agent when buying a house?

A: Hiring a real estate agent is highly recommended when buying a house. They have the expertise and knowledge to guide you through the process, negotiate on your behalf, and ensure that your interests are protected.

Q: How long does the home-buying process take?

A: The duration of the home-buying process can vary depending on factors such as market conditions, financing, and the complexity of the transaction. On average, it takes around 30 to 45 days from the time an offer is accepted to the closing of the deal.

Q: What is a home inspection, and is it necessary?

A: A home inspection is a thorough examination of the property’s condition conducted by a professional inspector. It is highly recommended to get a home inspection to identify any potential issues or repairs that may affect your decision to purchase.

Conclusion:

Celebrating your successful purchase

Congratulations on successfully navigating the process of purchasing a new house! This comprehensive guide has provided you with the necessary steps and information to make an informed decision. Remember to celebrate this milestone and enjoy the journey of turning your new house into a home.

Now that you are equipped with the knowledge and guidance to purchase a new house, it’s time to start your house-hunting journey. Contact a reliable real estate agent, set your budget, and begin exploring different neighborhoods. Your dream home awaits!