Unlock Credit Card Prequalification: A Guide to Opportunities!

Note: This article is provided for informational purposes only and should not be considered financial advice. Please consult with a professional financial advisor before making any credit card decisions.

Introduction to Credit Card Prequalification

If you’re in the market for a new credit card, you may have come across the term “prequalification.” But what exactly is credit card prequalification and how does it work? In this guide, we’ll explore the ins and outs of credit card prequalification and how it can open up opportunities for you. $950/week posting premade videos on YouTube

Credit card prequalification is essentially a way for credit card issuers to assess your likelihood of being approved for a credit card before you officially apply. It involves a soft credit check, which doesn’t impact your credit score, to determine if you meet the initial criteria set by the card issuer. This initial evaluation helps both you and the issuer determine if it’s worth proceeding with a formal application.

Benefits of Credit Card Prequalification

There are several benefits to exploring credit card prequalification. Firstly, it allows you to gauge your chances of being approved for a credit card without negatively impacting your credit score. This is especially important if you’re concerned about potential rejections affecting your creditworthiness.

Secondly, credit card prequalification can save you time and effort. By knowing which credit cards you have a higher chance of getting approved for, you can focus your energy on applying for those specific cards instead of wasting time on applications that are likely to be denied.

Finally, credit card prequalification can help you compare and evaluate different credit card offers. By seeing the terms and conditions upfront, you can make an informed decision about which credit card aligns best with your needs and financial goals.

How to Prequalify for a Credit Card

To prequalify for a credit card, there are a few steps you can take:

- Research Credit Card Issuers: Start by researching different credit card issuers and their prequalification processes. Look for issuers that offer prequalification tools or resources on their websites.

- Use Prequalification Tools: Once you’ve identified potential issuers, utilize their prequalification tools. These tools typically require you to provide basic information such as your name, address, and Social Security number. The issuer will then run a soft credit check to assess your eligibility.

- Review Prequalification Offers: After completing the prequalification process, you’ll receive a list of credit cards you may be eligible for. Take the time to review each offer, paying close attention to interest rates, fees, and rewards programs.

- Compare and Choose: Compare the prequalification offers you’ve received and choose the credit card that best suits your needs. Consider factors such as annual fees, introductory APRs, rewards programs, and any additional perks offered.

- Proceed with Application: Once you’ve selected a credit card, proceed with the formal application process. Keep in mind that prequalification doesn’t guarantee approval, but it does indicate a higher likelihood of being approved.

Tips for Maximizing Your Chances of Getting Prequalified

While credit card prequalification increases your chances of being approved for a credit card, there are a few tips you can follow to maximize your chances even further:

- Maintain a Good Credit Score: A strong credit score is one of the most important factors in the credit card prequalification process. Pay your bills on time, keep your credit utilization low, and avoid opening multiple new credit accounts in a short period. $850 per week for watching movies on Netflix

- Check Your Credit Report: Regularly review your credit report to ensure its accuracy. Dispute any errors or discrepancies that could negatively impact your prequalification chances.

- Pay Off Existing Debts: Lowering your debt-to-income ratio can positively impact your prequalification results. Pay off any outstanding debts or consider consolidating them to improve your overall financial profile.

- Limit Applications: While prequalification doesn’t impact your credit score, submitting multiple credit card applications can. Limit your applications to the cards you’re most interested in to avoid any negative consequences.

- Optimize Your Income: Credit card issuers may consider your income when evaluating your prequalification eligibility. Increase your chances by accurately reporting your income and providing supporting documentation if required.

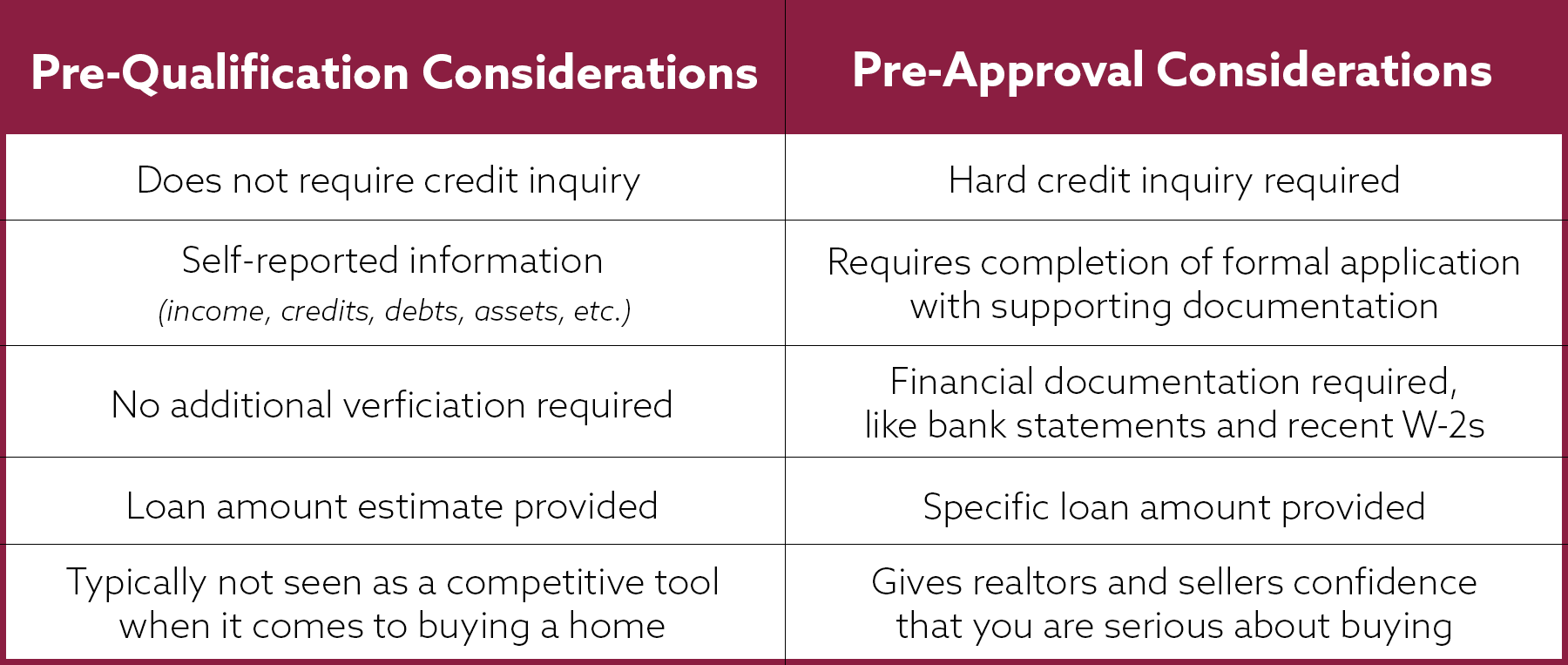

Understanding the Difference Between Prequalification and Preapproval

It’s important to distinguish between credit card prequalification and preapproval, as they are not interchangeable terms. Prequalification is an initial assessment based on a soft credit check, while preapproval involves a more detailed evaluation that includes a hard credit check.

Preapproval typically occurs after prequalification, and it indicates that the credit card issuer has conducted a thorough review of your credit history and financial standing. It’s a stronger indication of your eligibility and often comes with more concrete terms and conditions.

Remember that prequalification and preapproval are not guarantees of final approval. The issuer will still review your formal application and may request additional documentation before making a decision.

Common Misconceptions About Credit Card Prequalification

There are a few common misconceptions about credit card prequalification that are important to address:

- Prequalification Affects Your Credit Score: Contrary to popular belief, credit card prequalification does not impact your credit score. The soft credit check performed during prequalification does not leave a mark on your credit history.

- Prequalification Guarantees Approval: While credit card prequalification is a positive sign, it does not guarantee approval. It merely indicates that you meet the initial criteria set by the issuer. Final approval is still subject to a formal application and a more thorough evaluation.

- Prequalification Limits Your Options: Some people believe that prequalification restricts them to a specific credit card or issuer. However, prequalification is simply a tool to assess your eligibility for multiple credit card offers. You still have the freedom to choose the card that best suits your needs.

Best Credit Card Prequalification Tools and Resources

Several credit card issuers offer prequalification tools and resources to assist potential applicants. Here are a few reputable options:

- American Express: American Express provides a prequalification tool on their website, allowing you to check which of their cards you may be eligible for.

- Capital One: Capital One offers a prequalification tool that provides personalized credit card recommendations based on your input.

- Chase: Chase Bank’s prequalification tool allows you to see if you’re prequalified for any of their credit cards, giving you an idea of which cards you have a higher chance of being approved for.

Remember to research and compare different prequalification tools to find the one that aligns best with your needs. Article Writers – $250 a day

How Credit Card Prequalification Can Help You Improve Your Credit Score

Credit card prequalification can be a helpful tool in improving your credit score. By utilizing prequalification tools and resources, you can identify credit cards that are within your reach and align with your financial goals. Once approved for a credit card, responsible use, and timely payments can positively impact your credit score over time.

Additionally, prequalification allows you to avoid unnecessary credit inquiries. Since prequalification only involves a soft credit check, it doesn’t leave a mark on your credit history. This is important because hard credit inquiries, which occur during formal applications, can temporarily lower your credit score.

By prequalifying for credit cards and using them responsibly, you can build a strong credit history and improve your credit score in the long run.

FAQs

Q: Does prequalification guarantee approval for a credit card?

A: No, prequalification does not guarantee approval. It simply indicates that you meet the initial criteria set by the credit card issuer. Final approval is subject to a formal application and a more thorough evaluation.

Q: Will prequalification impact my credit score?

A: No, credit card prequalification involves a soft credit check, which does not impact your credit score. It’s a useful tool for assessing your eligibility without any negative consequences.

Q: Can I prequalify for multiple credit cards at once?

A: Yes, you can prequalify for multiple credit cards simultaneously. This allows you to compare offers and choose the card that best suits your needs.

Q: How often should I prequalify for credit cards?

A: There’s no set timeline for how often you should prequalify for credit cards. However, it’s recommended to do so when you’re actively searching for a new credit card or considering a change in your financial situation.

Conclusion

Credit card prequalification is a valuable tool that can help you unlock opportunities and make informed decisions when applying for new credit cards. By understanding the process, utilizing prequalification tools, and following the tips outlined in this guide, you can improve your chances of being approved for a credit card that aligns with your financial goals. How to make $1,000 per day on complete auto-pilot 24/7

Remember, credit card prequalification is just the first step in the application process. It’s important to review the terms and conditions of any offer before proceeding with a formal application. If you have any doubts or questions, consult with a professional financial advisor who can provide personalized guidance. Utilize the resources available to you, prequalify with confidence, and take advantage of the opportunities that credit card prequalification can offer.