Strategic Steps: 8 Intelligent Actions to Elevate

Your Credit Score!

Understanding your credit score

A good credit score is important because it opens doors to better financial opportunities. With a high credit score, you have access to lower interest rates on loans, credit cards with better rewards, and even better rental and job prospects. On the other hand, a poor credit score can limit your options and result in higher interest rates or even loan denials.” Now Hiring $30 Per Hour Facebook Chat Assistant!

Understanding your credit score is akin to deciphering your financial DNA, an essential step in navigating the complex landscape of personal finance. Imagine your credit score as a digital passport that accompanies you on your financial journey, influencing the opportunities available to you at every turn. This three-digit numerical representation encapsulates your financial habits, responsibilities, and reliability, serving as a crucial benchmark for financial institutions, landlords, and potential employers alike.

Delving into the depths of credit scoring unveils a multifaceted evaluation process that goes beyond mere numbers. It encompasses a holistic view of your financial behavior, including your payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries. Each of these components intertwines to craft a narrative about your financial responsibility and trustworthiness.

A stellar credit score acts as a golden ticket to a realm of advantageous financial prospects. It signifies to lenders that you are a low-risk borrower, deserving of lower interest rates and favorable loan terms. This translates into tangible savings over time, as lower interest rates mean reduced costs for borrowing money, whether for a mortgage, auto loan, or credit card balance. Moreover, premium credit cards with enticing rewards and perks often reserve their offerings for individuals with excellent credit scores, providing access to exclusive benefits such as cashback rewards, travel incentives, and concierge services. Post images on Social media for $200 per day

The benefits extend beyond borrowing, permeating into everyday financial interactions. Landlords frequently scrutinize credit scores when evaluating rental applications, preferring tenants with proven financial responsibility. A high credit score not only increases your chances of securing rental agreements but also opens doors to better rental properties and favorable lease terms. Likewise, potential employers may view a strong credit history as a marker of reliability and responsibility, influencing hiring decisions, especially for roles involving financial responsibilities or sensitive positions.

Conversely, a poor credit score paints a contrasting picture, laden with financial obstacles and limitations. It can lead to higher interest rates on loans, translating into increased costs over the loan’s lifetime. Additionally, lenders may impose stricter terms or outright deny loan applications, constraining your ability to access necessary funds for major purchases or emergencies. Rental applications may face rejections or necessitate higher security deposits, further straining your financial resources. Moreover, certain job opportunities may remain out of reach, as employers may perceive a low credit score as a red flag for financial irresponsibility or instability.

Understanding the nuances of credit scoring empowers individuals to proactively manage their financial well-being. Regularly monitoring your credit report for inaccuracies, maintaining timely payments, keeping credit utilization in check, and diversifying credit accounts are strategies that contribute positively to your credit score over time. Taking these proactive steps not only improves your current financial standing but also lays a robust foundation for a secure financial future.

In conclusion, your credit score is not just a number; it is a reflection of your financial habits, responsibilities, and opportunities. By comprehending its significance and taking proactive measures to nurture a healthy credit profile, you pave the way for a brighter financial future filled with opportunities and financial stability.

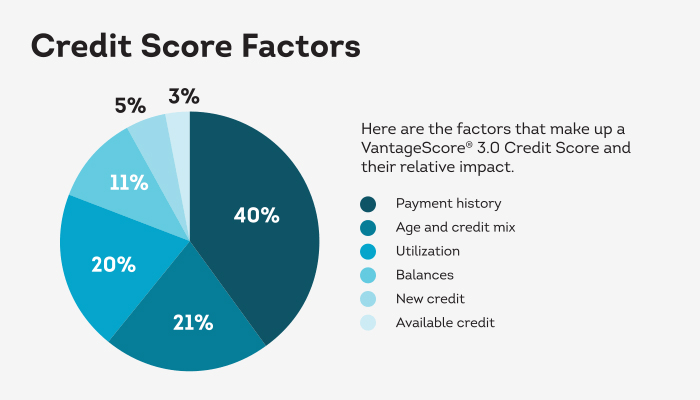

Factors that affect your credit score

Several factors contribute to your credit score. The most significant ones include your payment history, credit utilization ratio, length of credit history, new credit applications, and credit mix. By understanding how these factors work, you can identify areas for improvement and take targeted actions to boost your credit score.

Assessing your current credit score

Before you begin the journey of improving your credit score, it’s essential to assess where you currently stand. You can obtain a free copy of your credit report from the major credit bureaus – Equifax, Experian, and TransUnion. Review the report for any errors or discrepancies that may be negatively impacting your credit score. If you find any inaccuracies, make sure to dispute them and have them corrected.

Step 1: Pay your bills on time

Paying your bills on time is the most crucial step in improving your credit score. Late payments can severely damage your score, so make it a priority to pay all your bills by the due date. Set up automatic payments or reminders to ensure you never miss a payment. If you’re struggling to make ends meet, contact your creditors and explore the possibility of negotiating a payment plan.

Step 2: Reduce your credit card balances

High credit card balances can negatively impact your credit score, even if you make your payments on time. Aim to keep your credit card balances below 30% of your total credit limit. If you have high balances, create a plan to pay them down strategically. Consider making more than the minimum payment each month to accelerate your progress. $850 per week for watching movies on Netflix

Step 3: Avoid new credit applications

Every time you apply for new credit, it creates a hard inquiry on your credit report, which can lower your score. Avoid unnecessary credit applications, especially if you’re actively working on improving your credit. Focus on managing your existing credit responsibly before seeking new credit opportunities.

Step 4: Check your credit report for errors

Mistakes can happen, and they can negatively impact your credit score. Regularly review your credit report for any errors or inaccuracies. If you find any, dispute them with the credit bureaus and provide supporting documentation to have them corrected. Fixing these errors can give your credit score a much-needed boost.

Step 5: Diversify your credit mix

Having a diverse credit mix can positively impact your credit score. Lenders like to see that you can handle different types of credit responsibly. Consider diversifying your credit mix by having a combination of credit cards, installment loans, and a mortgage, if possible. However, remember not to open new accounts just for the sake of diversifying your credit mix.

Step 6: Keep old accounts open

The length of your credit history is an important factor in determining your credit score. If you have old accounts with a positive payment history, keep them open, even if you’re not actively using them. Closing old accounts can shorten your credit history, which may hurt your score. Article Writers – $250 a day

Step 7: Use credit wisely

Responsible credit usage is key to maintaining a good credit score. Avoid maxing out your credit cards and aim to keep your credit utilization ratio below 30%. Use credit sparingly and only for necessary expenses. Regularly monitor your credit card statements for any unauthorized charges or suspicious activity.

Step 8: Be patient and stay consistent

Improving your credit score takes time and patience. It’s essential to stay consistent with your efforts and make responsible financial choices over an extended period. Keep paying your bills on time, reducing your credit card balances, and following the other steps outlined here. With time, you will see your credit score gradually improve.

Resources for credit score improvement

If you need additional guidance and resources to improve your credit score, some several reputable organizations and websites can help. Some useful resources include credit counseling agencies, financial education programs, and online tools that provide personalized credit improvement recommendations.

FAQs

- What is a good credit score range? A good credit score typically falls within the range of 670 to 850. However, the specific range may vary depending on the credit scoring model used by lenders.

- How long does it take to improve a credit score? The time it takes to improve a credit score depends on various factors, including the individual’s credit history and the actions taken to improve the score. Generally, it can take several months to a year or more to see significant improvements.

National Stats

According to recent statistics, the average credit score in the country is around 710. However, around 30% of Americans have credit scores below 650, which may limit their access to favorable financial opportunities.

Conclusion

Your credit score plays a vital role in your financial journey. By understanding the factors that affect your credit score and implementing the strategic steps outlined in this article, you can elevate your credit score and unlock a world of better financial opportunities. Remember to be patient, stay consistent, and make responsible financial choices. With time and effort, you can achieve a higher credit score and take control of your financial future.

Take charge of your financial future today by implementing these intelligent actions to elevate your credit score. Remember, every step you take brings you closer to better financial opportunities. Start now and experience the difference a good credit score can make in your life.