7 Essential Factors to Consider Before Applying

for a Second Credit Card!

Introduction to applying for a second credit card

If you’re considering applying for a second credit card, it’s important to take several factors into account before making a decision. While having an additional credit card can provide financial flexibility and convenience, it also comes with responsibilities and potential risks. This article will guide you through the essential factors to consider before applying for a second credit card, ensuring that you make an informed decision that aligns with your financial goals. $28.50/hr To Write On Facebook

Level Up Your Wallet: The Smart Guide to Getting a Second Credit Card

Imagine a world where your everyday purchases fuel exciting rewards, where responsible credit use strengthens your financial profile, and where managing multiple cards becomes a breeze. Well, that world can be yours with a strategically chosen second credit card.

This guide dives deep into the smart way to navigate the world of second credit cards. We’ll explore the benefits and potential drawbacks, help you assess your financial readiness, and guide you toward choosing the perfect card that aligns with your spending habits and financial goals. So, buckle up and get ready to unlock the true potential of plastic!

A second credit card can be a powerful tool, but like any tool, it requires responsible use. Having a well-managed second card can bring a multitude of benefits:

- Enhance Rewards and Cash Back: Imagine earning points, miles, or cash back on everyday purchases. The right second card can significantly boost your rewards game, translating your spending into valuable perks like travel, merchandise, or statement credits.

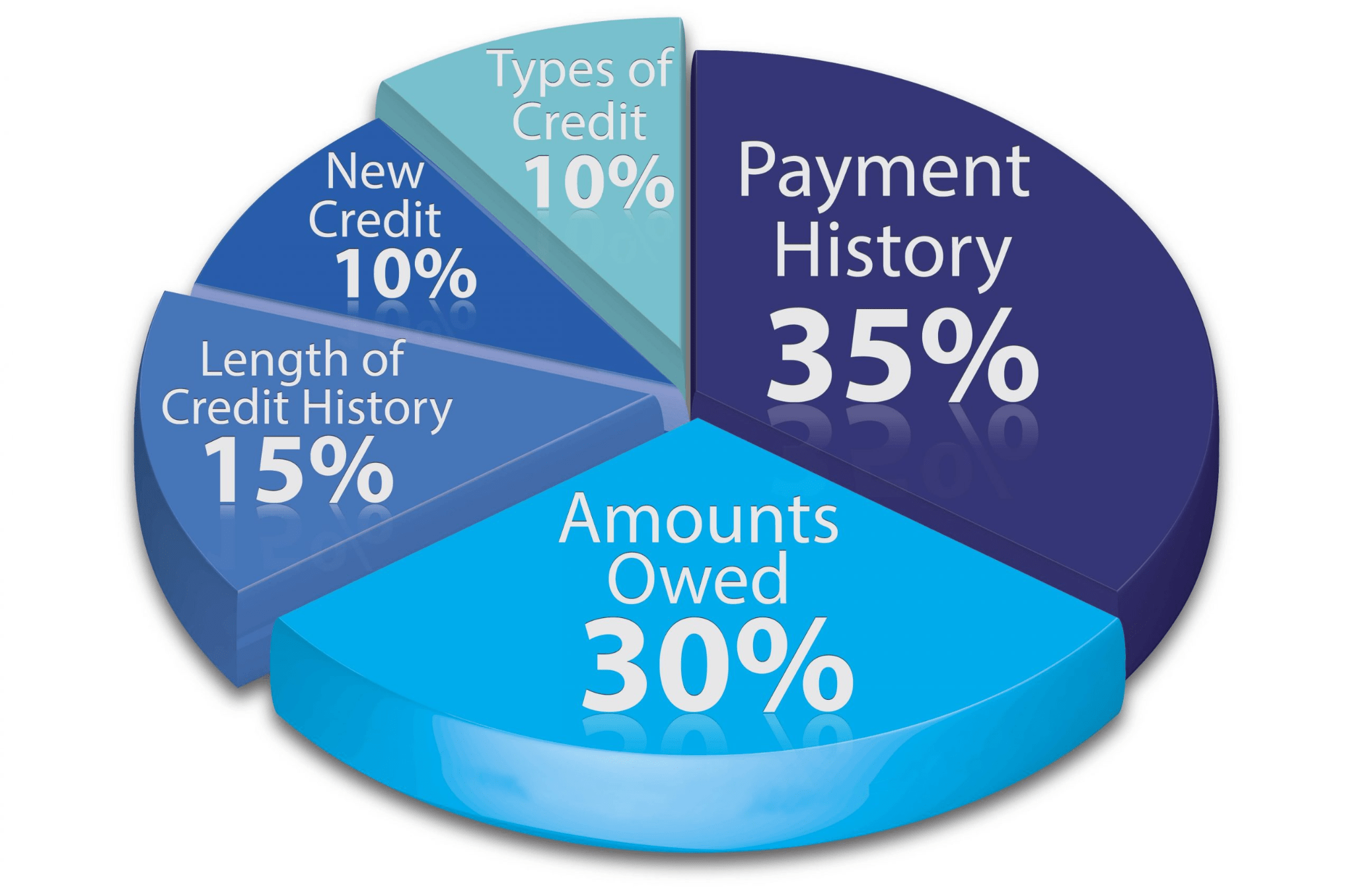

- Diversify Your Credit Mix: Credit bureaus love a healthy mix of credit products (installment loans, credit cards, etc.). A second card expands your credit profile, potentially giving your score a slight boost.

- Increase Credit Limit and Lower Utilization: With a second card, your total credit limit increases. This can significantly lower your credit utilization ratio (the amount of credit you’re using compared to your total limit). A lower utilization ratio is a major factor influencing your credit score – generally, the lower, the better.

- Build Credit History Faster (for Thin Files): If you’re new to credit or have a limited credit history (a “thin file”), a responsibly used second card can help build a stronger credit profile more quickly.

However, it’s important to acknowledge the potential downsides:

- Increased Debt Temptation: Having readily available credit can be a double-edged sword. Responsible budgeting and timely payments are crucial to avoid falling into the trap of high-interest debt.

- Annual Fees and Interest Charges: Not all cards are created equal. Some cards with enticing rewards programs come with annual fees. Additionally, interest charges can quickly snowball if you carry a balance. Choose your card wisely and make sure the rewards outweigh the costs.

- Managing Multiple Cards Can Be Tricky: Juggling multiple cards requires discipline. Utilize budgeting tools and set up automatic payments to avoid missed payments and late fees. Instagram Chat Assistant – $250 a Day

The importance of considering your credit score

Before applying for a second credit card, it is crucial to assess your credit score. Your credit score plays a significant role in determining your creditworthiness, and it directly impacts the interest rates and credit limits you’ll be eligible for. A healthy credit score indicates to lenders that you are a responsible borrower, making it more likely for you to secure favorable terms. On the other hand, a low credit score may result in higher interest rates or even rejection of your credit card application. Therefore, it’s essential to obtain a copy of your credit report and review it carefully to ensure accuracy before proceeding with a second credit card application.

Another aspect to consider is the potential impact on your credit utilization ratio. This ratio measures the amount of credit you are using compared to your total available credit. When you apply for a second credit card, it increases your total available credit, which can positively impact your credit utilization ratio if you maintain the same level of credit usage. However, if you start utilizing a larger portion of your available credit, it may negatively affect your credit score. It’s important to keep a close eye on your credit utilization ratio and aim to keep it below 30% to maintain a healthy credit profile.

Evaluating your current financial situation and budget

Before obtaining a second credit card, it’s crucial to evaluate your current financial situation and budget. Take into account your income, expenses, and any outstanding debts you may have. Consider whether you have the financial means to manage an additional credit card responsibly. It’s important to ensure that you can comfortably make the minimum monthly payments and avoid accumulating excessive debt. If you’re struggling with existing debt, it may be wise to focus on paying it off before considering a second credit card. Additionally, assess your spending habits and determine whether you have the discipline to use a second credit card responsibly, avoid unnecessary purchases and maintain a healthy financial balance.

Researching and comparing credit card options

When applying for a second credit card, it’s essential to conduct thorough research and compare different credit card options. Each credit card comes with its own set of terms, rewards, fees, and interest rates. Look for credit cards that align with your financial goals and spending habits. Consider factors such as annual fees, interest rates, cashback rewards, and any additional benefits offered by the credit card issuer. Take the time to read the fine print and understand all the terms and conditions associated with each card. Comparing multiple options will allow you to make an informed decision and choose a credit card that best suits your needs.

Assessing the fees and interest rates associated with a second credit card

Before applying for a second credit card, carefully assess the fees and interest rates associated with each card. Some credit cards may have high annual fees or maintenance charges, which can significantly impact your overall cost of owning the card. Additionally, be aware of the interest rates charged on outstanding balances. If you plan to carry a balance on your credit card from month to month, a high interest rate can result in substantial interest charges over time. Look for credit cards with reasonable fees and competitive interest rates to minimize your expenses and maximize your financial benefits.

Considering the benefits and rewards offered by different credit cards

One of the advantages of having a second credit card is the potential for additional benefits and rewards. Many credit cards offer various perks, such as cashback rewards, travel points, or discounts on specific purchases. Consider which benefits are most appealing to you and align with your spending habits. If you frequently travel, a credit card that offers travel rewards or airline miles might be advantageous. On the other hand, if you primarily use your credit card for everyday purchases, a card with cashback rewards may be more beneficial. By carefully considering the benefits and rewards offered by different credit cards, you can maximize your financial gains and enhance your overall credit card experience. $280 per day posting YouTube comments

Understanding the potential impact on your credit history and creditworthiness

Applying for a second credit card can have implications for your credit history and creditworthiness. When you apply for a new credit card, the credit card issuer will typically perform a hard inquiry on your credit report, which can temporarily lower your credit score. However, this impact is usually minimal and short-lived, especially if you have a strong credit history. It’s important to be mindful of the timing of your credit card applications and avoid applying for multiple credit cards within a short period. Additionally, ensure that you continue to make timely payments and maintain responsible credit behavior to protect and improve your credit history.

Making an informed decision and applying for a second credit card

After carefully considering all the factors mentioned above, you should be well-equipped to make an informed decision regarding your second credit card application. Choose a credit card that aligns with your financial goals, offers favorable terms and rewards, and fits within your budget. Before submitting your application, review all the required information and documentation to ensure accuracy. Take the time to read and understand the terms and conditions of the credit card agreement. Once you are confident in your decision, proceed with the application process and await the credit card issuer’s response. Earn $20 an Hour Listening to Spotify

Conclusion and final thoughts

Obtaining a second credit card can be a valuable financial tool if used responsibly and thoughtfully. By considering your credit score, and financial situation, researching credit card options, evaluating fees and benefits, and understanding the potential impact on your credit history, you can make an informed decision that aligns with your financial goals. Remember, a second credit card should be a complement to your financial strategy, not a means to accumulate unnecessary debt. Use it wisely, make timely payments, and enjoy the benefits it can provide.

FAQs

Q: Will applying for a second credit card negatively impact my credit score?

A: Applying for a new credit card will typically result in a temporary decrease in your credit score due to the hard inquiry performed by the credit card issuer. However, this impact is usually minimal and short-lived, especially if you have a strong credit history.

Q: How can I choose the best second credit card for my needs?

A: To choose the best second credit card, carefully consider your financial goals, spending habits, and the benefits offered by different credit cards. Research and compare options, paying attention to fees, interest rates, and rewards programs. Choose a credit card that aligns with your needs and financial preferences.

Q: Is it better to pay off existing debt before applying for a second credit card?

A: If you are currently struggling with existing debt, it may be wise to focus on paying it off before considering a second credit card. Paying off debt will improve your creditworthiness and financial stability, setting a strong foundation for managing a second credit card responsibly.

National Stats

According to recent studies, the average American has two credit cards. This indicates that many individuals find value in having multiple credit cards to meet their financial needs. However, it’s important to note that responsible credit card usage is crucial to maintain a healthy financial profile. By considering the essential factors outlined in this article, you can make an informed decision when applying for a second credit card and reap the benefits it can offer.