Navigating Towards a Debt-Free Future: Essential

Tips from Financial Experts to Conquer Your Debt!

Understanding Debt and Its Impact on Your Financial Future

Debt is a common financial burden that many individuals face. Whether it’s student loans, credit card debt, or a mortgage, being in debt can have a significant impact on your financial future. Understanding the different types of debt and how they affect your overall financial health is essential in navigating towards a debt-free future.

There are two main types of debt: good debt and bad debt. Good debt is an investment that will provide long-term benefits, such as a mortgage or student loans. These types of debt can help you build assets or increase your earning potential. On the other hand, bad debt includes credit card debt and high-interest loans. Bad debt can quickly spiral out of control, leading to financial stress and a negative impact on your credit score.

To take control of your debt, it’s crucial to assess your current financial situation. Calculate your total debt, including the interest rates and monthly payments for each debt. This will give you a clear picture of your debt-to-income ratio and help you prioritize which debts to tackle first. Additionally, monitoring your credit score regularly is essential as it plays a significant role in your ability to secure loans or lower interest rates. Facebook Messenger Job – $30/hr

The Psychology of Debt and How to Change Your Mindset

Dealing with debt is not just a financial challenge; it’s also a psychological one. The stress and anxiety associated with being in debt can take a toll on your mental well-being. To conquer your debt, it’s crucial to change your mindset and adopt a positive outlook towards your financial situation.

One effective strategy is reframing your perspective on debt. Instead of viewing it as a burden, see it as an opportunity for growth and learning. Use your debt as motivation to improve your financial habits and make smarter financial decisions. Celebrate small victories along the way, such as paying off a credit card or reducing your overall debt.

Another important aspect of changing your mindset is practicing self-compassion. It’s easy to beat yourself up over past financial mistakes, but it’s important to remember that everyone makes them. Instead of dwelling on the past, focus on the present and the steps you can take to improve your financial future. Surround yourself with a supportive network of friends and family who can encourage and motivate you during this journey.

Steps to Create a Debt Repayment Plan

Creating a debt repayment plan is crucial in taking control of your financial future. It’s essential to have a clear roadmap that outlines your goals and the steps you need to take to achieve them. Here are some steps to help you create an effective debt repayment plan:

- Assess Your Current Debt: Start by gathering all the necessary information about your outstanding debts. Make a list of each debt, including the interest rates, minimum monthly payments, and outstanding balances. This will give you an overview of your debt and help you prioritize which debts to tackle first.

- Set SMART Goals: SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Set specific goals for paying off your debt, such as paying off a certain amount each month or becoming debt-free within a specific timeframe. Having clear and measurable goals will keep you motivated and focused.

- Create a Budget: A budget is a crucial tool in managing your finances and paying off debt. Start by tracking your income and expenses to get a clear picture of your financial situation. Identify areas where you can cut back on expenses and allocate more money towards debt repayment. Stick to your budget religiously and make adjustments as needed. $40 per tweet for you

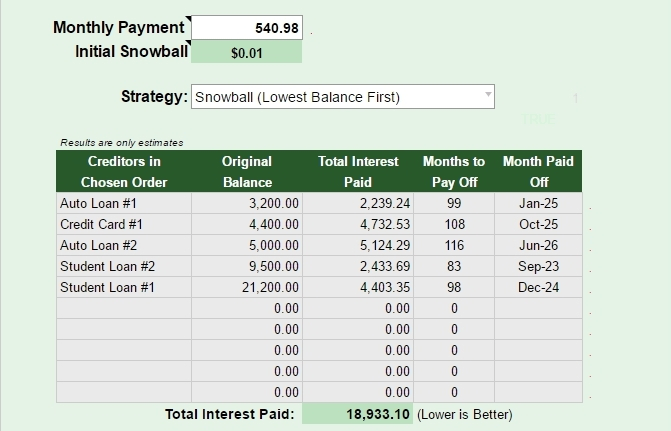

- Explore Debt Repayment Strategies: There are several debt repayment strategies you can consider, such as the snowball method or the avalanche method. With the snowball method, you focus on paying off the smallest debt first while making minimum payments on other debts. Once the smallest debt is paid off, you move on to the next smallest debt. The avalanche method, on the other hand, focuses on paying off debts with the highest interest rates first. Choose the strategy that works best for you and aligns with your financial goals.

- Track Your Progress: Regularly monitor your progress and celebrate small victories along the way. Seeing your debt decrease and your financial situation improve will provide the motivation you need to stay on track.

By following these steps and staying committed to your debt repayment plan, you’ll be well on your way to a debt-free future.

Tips for Budgeting and Managing Your Finances

Budgeting and managing your finances effectively are essential components of conquering your debt. Here are some tips to help you create a realistic budget and take control of your financial situation:

- Track Your Expenses: Start by tracking your expenses for at least a month to get a clear picture of where your money is going. Use a spreadsheet or a budgeting app to categorize your expenses and identify areas where you can cut back.

- Create a Realistic Budget: Based on your expense tracking, create a realistic budget that aligns with your financial goals. Allocate money for essential expenses such as housing, utilities, and groceries, as well as debt repayment and savings. Be sure to leave room for discretionary spending, but keep it within reason.

- Automate Your Savings: Set up automatic transfers from your checking account to a savings account each month. This will help you build an emergency fund and save for future expenses without having to think about it.

- Cut Back on Non-Essential Expenses: Identify non-essential expenses that you can temporarily cut back on to free up more money for debt repayment. This could include eating out less frequently, canceling unused subscriptions, or finding more affordable alternatives for entertainment.

- Negotiate Lower Interest Rates: Contact your creditors and ask for lower interest rates or a reduced payment plan. Many creditors are willing to work with you if you demonstrate a genuine commitment to repaying your debt.

Remember, budgeting and managing your finances effectively is an ongoing process. Regularly review and adjust your budget as needed to ensure that you’re making progress towards your financial goals.

Exploring Debt Consolidation Options

Debt consolidation is a strategy that involves combining multiple debts into a single loan with a lower interest rate. This can make it easier to manage your debt and potentially save money on interest payments. Here are some debt consolidation options to consider:

- Balance Transfer Credit Cards: Many credit card companies offer balance transfer credit cards with low or 0% APR for an introductory period. Transferring your high-interest credit card balances to a balance transfer card can help you save on interest and pay off your debt faster.

- Personal Loans: Taking out a personal loan to consolidate your debt can be an effective strategy, especially if you can secure a lower interest rate than your current debts. Personal loans are unsecured, meaning you don’t need to put up collateral, but your credit score will be a determining factor in the interest rate you’re offered.

- Home Equity Loans or Lines of Credit: If you own a home, you may be able to use the equity in your property to secure a loan or line of credit to consolidate your debt. Home equity loans typically offer lower interest rates, but remember that your home is on the line if you’re unable to make the payments.

Before pursuing debt consolidation, carefully consider the terms and potential costs involved. Evaluate whether the lower interest rate and simplified payment structure outweigh any fees or potential risks. It’s also important to address the underlying issues that led to your debt in the first place to prevent future financial challenges.

Strategies for Negotiating with Creditors

If you’re struggling to make your debt payments, it’s worth reaching out to your creditors to explore negotiation options. Here are some strategies for negotiating with creditors:

- Communicate Early: Don’t wait until you’re behind on payments to contact your creditors. Call them as soon as you anticipate having difficulty making a payment. Explain your situation and ask if they can offer any temporary relief, such as a reduced payment plan or a temporary suspension of payments.

- Be Honest and Transparent: When negotiating with creditors, it’s essential to be honest and transparent about your financial situation. Provide them with accurate information about your income, expenses, and assets. This will help them understand your circumstances and determine the best course of action.

- Propose a Repayment Plan: If you’re unable to make the full payment, propose a realistic repayment plan that you can afford. This could involve reducing the interest rate, extending the repayment period, or reducing the overall debt owed. Creditors may be willing to work with you if they see that you’re committed to repaying your debt.

- Get Everything in Writing: Once you’ve reached an agreement with your creditors, make sure to get all the terms and conditions in writing. This will protect you from any future disputes or misunderstandings.

Remember, negotiating with creditors may not always be successful, but it’s worth exploring your options. Even if you’re unable to negotiate a lower payment or interest rate, creditors may be able to offer temporary relief or refer you to resources that can help you manage your debt. $30 per photo you take

The Importance of Building an Emergency Fund

Building an emergency fund is a crucial step in achieving financial security and conquering your debt. An emergency fund provides a safety net that can help you avoid going further into debt when unexpected expenses arise. Here are some reasons why building an emergency fund is essential:

- Protection Against Unexpected Expenses: Life is full of surprises, and unexpected expenses can quickly derail your financial progress. Whether it’s a car repair, a medical emergency, or a job loss, having an emergency fund can provide the financial cushion you need to handle these situations without relying on credit cards or loans.

- Reduction of Financial Stress: Knowing that you have a financial safety net can significantly reduce stress and anxiety. You’ll have peace of mind knowing that you’re prepared for any unforeseen circumstances that may arise.

- Prevention of Future Debt: Without an emergency fund, you may be forced to rely on credit cards or loans to cover unexpected expenses. This can lead to a cycle of debt that becomes increasingly difficult to break. By having an emergency fund, you can avoid going further into debt and maintain financial stability.

To build an emergency fund, start by setting a realistic savings goal. Aim to save at least three to six months’ worth of living expenses, although this may vary depending on your circumstances. Automate your savings by setting up automatic transfers from your paycheck or checking account to a separate savings account. Make it a priority to contribute to your emergency fund regularly, even if it’s a small amount to start with. Over time, your emergency fund will grow, providing you with a sense of security and financial stability.

Ways to Increase Your Income and Save Money

Increasing your income and saving money can significantly accelerate your journey towards a debt-free future. Here are some strategies to help you boost your income and save money:

- Explore Side Hustles: Consider taking on a side hustle or freelance work to supplement your income. There are numerous opportunities available, such as driving for a rideshare service, freelancing in your area of expertise, or starting an online business. Use your skills and interests to find a side gig that works for you.

- Review Your Expenses: Take a close look at your monthly expenses and identify areas where you can cut back. This could include reducing discretionary spending, negotiating lower bills for services such as cable or internet, or finding more affordable alternatives for everyday items.

- Maximize Your Savings: Take advantage of savings opportunities, such as employer-matched retirement contributions or tax-advantaged savings accounts like a 401(k) or an IRA. Contribute the maximum amount allowed to these accounts to benefit from tax advantages and employer contributions.

- Pay Yourself First: Treat your savings as a non-negotiable expense. Set up automatic transfers to a separate savings account or investment account each time you receive income. By paying yourself first, you prioritize saving and make it a regular habit.

- Reduce Debt-Related Expenses: Look for ways to reduce the costs associated with your debt. This could involve refinancing your mortgage or student loans to secure a lower interest rate, consolidating high-interest credit card debt into a lower-interest loan, or negotiating with creditors to reduce fees or interest charges.

By increasing your income and saving money, you’ll have more resources available to pay off your debt and achieve financial freedom.

How to Stay Motivated and Track Your Progress

Staying motivated throughout your debt repayment journey can be challenging, but it’s crucial for long-term success. Here are some strategies to help you stay motivated and track your progress: Article Writers – $250 a day

- Set Milestones: Break your debt repayment journey into smaller milestones to make it more manageable and celebrate your progress along the way. For example, set a milestone for paying off a specific debt or reaching a certain percentage of your overall debt reduction goal.

- Visualize Your Debt-Free Future: Create a visual representation of your debt repayment journey, such as a debt-free thermometer or a vision board. Place it somewhere visible, like your refrigerator or your desk, to serve as a reminder of your goals and the progress you’ve made.

- Reward Yourself: Treat yourself occasionally when you achieve a milestone or make significant progress towards your debt repayment goals. This could be a small indulgence, such as a movie night or a dinner at your favorite restaurant. Rewards can help keep you motivated and provide a sense of accomplishment.

- Track Your Progress: Use a debt-tracking tool or spreadsheet to monitor your progress regularly. Update it each time you make a payment or achieve a milestone. Seeing your debt decrease and your progress towards financial freedom can be incredibly motivating.

- Find Support: Surround yourself with a supportive network of friends, family, or online communities who are also on a debt repayment journey. Share your successes, challenges, and advice with each other. Having a support system can provide motivation, accountability, and a sense of camaraderie.

Remember, staying motivated is a continuous effort. There may be times when you feel discouraged or tempted to give up. During these moments, remind yourself of your goals, the progress you’ve made, and the brighter financial future that awaits you.

Seeking Professional Help: When to Consider Credit Counseling or Debt Settlement

Sometimes, despite your best efforts, managing your debt on your own may become overwhelming or unmanageable. In such cases, seeking professional help can provide the guidance and support you need. Here are two options to consider: credit counseling and debt settlement.

- 1. Credit Counseling: This service involves working with a certified credit counselor who helps you analyze your financial situation, create a budget, and develop a personalized plan to manage your debt. Credit counselors can negotiate with creditors to lower interest rates and waive fees, making it easier for you to repay your debts.

- 2. Debt Settlement: Debt settlement companies negotiate with your creditors on your behalf to reduce the total amount of debt you owe. While this option may lower your overall debt, it can impact your credit score and come with associated risks. It’s crucial to thoroughly research and understand the terms and conditions before opting for debt settlement.