The Ultimate Guide to Harnessing the Power

of 5 Game-Changing Money Saving Hacks!

Introduction: The importance of saving money and the potential impact of game-changing money-saving hacks

Saving money is a crucial aspect of financial well-being. Whether you’re looking to build an emergency fund, save for a down payment on a house, or plan for retirement, having a solid savings strategy is essential. In this guide, we will explore five game-changing money-saving hacks that can help you reach your financial goals faster than ever before. By implementing these hacks, you’ll not only save money but also develop good financial habits that will benefit you in the long run. Post Images for $200 Per Day!

Money-saving hack #1: Automating your savings

One of the most effective ways to save money is by automating your savings. By setting up an automatic transfer from your checking account to your savings account on a regular basis, you remove the temptation to spend that money elsewhere. Start by determining how much you can comfortably save each month, and then set up an automatic transfer for that amount. This way, you’ll be consistently building your savings without even having to think about it.

Another great way to automate your savings is by using apps or online platforms that round up your purchases and deposit the spare change into your savings account. This simple trick can add up over time and help you save without even noticing it. By automating your savings, you’ll be on track to reach your financial goals faster and with less effort.

Money-saving hack #2: Cutting out unnecessary expenses

One of the most effective ways to save money is by cutting out unnecessary expenses. Take a close look at your monthly budget and identify areas where you can make cuts. For example, do you really need that gym membership you rarely use? Can you find a more affordable alternative for your cable or streaming services? By eliminating or reducing these unnecessary expenses, you’ll free up more money to put towards your savings. Write Blog Posts $35 An Hour!

Another great way to cut out unnecessary expenses is by renegotiating your bills. Contact your service providers and ask if there are any promotions or discounts available. You’ll be surprised at how often they are willing to work with you to retain your business. Additionally, consider shopping around for better deals on insurance, internet, and other services. By being proactive and cutting out unnecessary expenses, you’ll be able to save a significant amount of money each month.

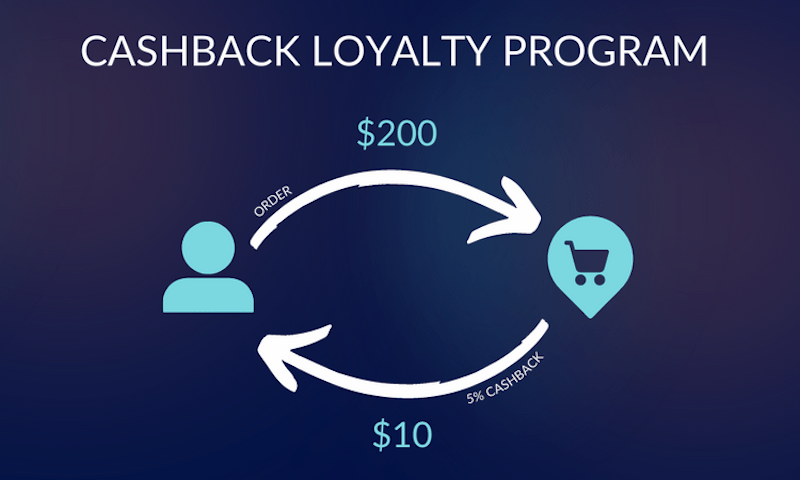

Money-saving hack #3: Utilizing cashback and rewards programs

Cashback and rewards programs are a great way to save money on your everyday purchases. Many credit cards offer cashback or rewards points for every dollar you spend. By using these cards responsibly and paying off your balance in full each month, you can earn money or redeem points for various rewards. Additionally, there are cashback websites and apps that offer you a percentage of your purchase back when you shop through their platform.

To maximize your savings, consider using cashback and rewards programs in conjunction with your regular shopping habits. Before making a purchase, check if there are any cashback offers or rewards available. By taking advantage of these programs, you’ll be able to save money on things you would have bought anyway. Just make sure to use these programs responsibly and avoid overspending just for the sake of earning rewards.

Money-saving hack #4: Meal planning and cooking at home

Eating out can be a significant drain on your finances. By meal planning and cooking at home, you can save a substantial amount of money each month. Start by creating a weekly meal plan and making a grocery list based on that plan. This way, you’ll know exactly what ingredients you need and won’t be tempted to make unnecessary purchases at the store. $25 an Hour Chat on Twitter Job!

When cooking at home, try to make larger portions and freeze the leftovers for future meals. This will not only save you time but also money, as you can stretch your ingredients further. Additionally, consider batch cooking on the weekends and preparing meals in advance for the week. This way, you’ll have ready-made meals and won’t be tempted to order takeout or dine out when you’re pressed for time.

Money-saving hack #5: Negotiating bills and expenses

Many people overlook the power of negotiation when it comes to saving money. Whether it’s your cable bill, insurance premiums, or even your rent, there’s often room for negotiation. Start by researching the market rates for the services you’re paying for. Armed with this knowledge, contact your service providers and ask if they can offer you a better deal. How to make $1,000 per day on complete auto-pilot 24/7

When negotiating, be polite but firm. Highlight your loyalty as a customer and mention any competitor offers you’ve received. In many cases, service providers are willing to lower your rates or provide additional perks to keep your business. By taking the time to negotiate your bills and expenses, you can potentially save hundreds or even thousands of dollars each year.

Additional tips for maximizing your savings

In addition to the game-changing money-saving hacks mentioned above, here are some additional tips to help you maximize your savings:

- Track your spending: Keeping a close eye on your expenses will help you identify areas where you can cut back and save more.

- Set realistic goals: Make sure your savings goals are attainable and adjust them as your financial situation changes.

- Prioritize debt repayment: If you have high-interest debt, focus on paying it off as soon as possible. The interest saved can be redirected towards your savings.

- Make saving a priority: Treat saving money as a regular expense and prioritize it in your budget. Pay yourself first before allocating funds to other expenses.

Case studies of individuals who have successfully implemented these money-saving hacks

To illustrate the effectiveness of these game-changing money-saving hacks, let’s take a look at a few case studies:

- Sarah, a working professional, automated her savings and managed to save $10,000 in just one year. She used the Spare Change app and set up automatic transfers to her savings account.

- John, a college student, cut out unnecessary expenses by canceling his unused gym membership, finding a cheaper streaming service, and renegotiating his internet bill. He was able to save $200 per month, which he put towards his tuition fees.

- Emily, a young mother, started meal planning and cooking at home. By doing so, she reduced her family’s grocery bill by 30% and was able to save an additional $300 per month.

These case studies demonstrate how ordinary individuals can achieve significant savings by implementing these money-saving hacks.

Tools and resources to help you implement these hacks

There are several tools and resources available to assist you in implementing these game-changing money-saving hacks:

- Budgeting apps: Apps like Mint, YNAB, and Personal Capital can help you track your expenses, set savings goals, and automate your finances.

- Cashback websites and apps: Platforms like Rakuten, Swagbucks, and Honey offer cashback and rewards programs to help you save money on your everyday purchases.

- Meal planning apps: Apps like Mealime, Plan to Eat, and Paprika can assist you in creating meal plans, generating grocery lists, and organizing your recipes.

- Negotiation scripts and tips: Websites like The Penny Hoarder and Money Saving Expert provide negotiation scripts and tips to help you get the best deals on your bills and expenses.

By utilizing these tools and resources, you’ll have the support you need to implement these money-saving hacks effectively.

Conclusion: Taking action and reaping the benefits of these game-changing money-saving hacks

Saving money doesn’t have to be a daunting task. By harnessing the power of these game-changing money-saving hacks, you can make significant progress toward your financial goals. Automating your savings, cutting out unnecessary expenses, utilizing cashback and rewards programs, meal planning and cooking at home, and negotiating bills and expenses are all powerful strategies that can help you save more money and build a secure financial future.

Now it’s time to take action. Review your finances, identify areas where you can implement these money-saving hacks, and start making changes today. Remember, the key to success is consistency and discipline. Stay committed to your savings goals, and you’ll soon start reaping the benefits of your efforts. Start saving, and watch your financial future flourish.

Start implementing these game-changing money-saving hacks today and take control of your finances. Your future self will thank you!