Mastering Money-Saving Habits: Strategies

For Every Budget!

Understanding Money-Saving Habits

When it comes to managing your finances, understanding money-saving habits is essential. These habits can help you achieve your financial goals, build a secure future, and gain peace of mind. But what exactly are money-saving habits? Simply put, they are the actions and behaviors you adopt to save money and make the most of your hard-earned income. Want To Earn An Extra $2000 Per Month?

Developing money-saving habits has numerous benefits. Not only can they help you accumulate savings, but they also cultivate discipline, resilience, and financial literacy. By being mindful of your spending habits and making conscious choices, you can take control of your financial well-being and create a stable foundation for the future.

Benefits of Adopting Money-Saving Habits

Adopting money-saving habits offers a range of benefits that extend beyond your bank account. Firstly, it provides a sense of security and peace of mind. Knowing that you have savings to fall back on in times of emergency or unexpected expenses can alleviate stress and anxiety. Additionally, saving money allows you to pursue your long-term goals, such as buying a house, starting a business, or retiring comfortably.

Furthermore, money-saving habits can lead to a more sustainable lifestyle. By being conscious of your spending and consumption patterns, you reduce waste and contribute to a healthier planet. Saving money also enables you to give back to your community and support causes that are important to you. Whether it’s donating to charity or investing in social enterprises, your savings can make a positive impact on the world around you.

The Psychology Behind Money-Saving Habits

Understanding the psychology behind money-saving habits can help you develop effective strategies for long-term success. One key aspect is recognizing the difference between needs and wants. By distinguishing between essential expenses and discretionary spending, you can prioritize your financial resources and make informed choices.

Another psychological factor is the power of delayed gratification. It can be tempting to indulge in instant gratification and make impulse purchases, but learning to delay gratification can significantly impact your financial well-being. By forgoing immediate pleasures and saving your money instead, you can reap greater rewards in the future.

Lastly, the role of habits and routines cannot be underestimated. By incorporating money-saving habits into your daily life, they become second nature over time. Automating savings, tracking your expenses, and setting reminders are all strategies that can help reinforce positive financial behaviors.

Setting Financial Goals and Creating a Budget

A crucial step in mastering money-saving habits is setting clear financial goals and creating a budget. Start by identifying your short-term and long-term objectives. Do you want to pay off debt, save for a down payment on a house, or retire early? Having specific goals gives you a clear direction and motivation to save.

Once you have your goals in mind, it’s time to create a budget. Begin by calculating your monthly income and subtracting your fixed expenses, such as rent, utilities, and loan payments. Allocate a portion of your remaining income towards savings and prioritize it as a non-negotiable expense. Finally, plan for discretionary spending by setting a realistic limit for entertainment, dining out, and other non-essential expenses.

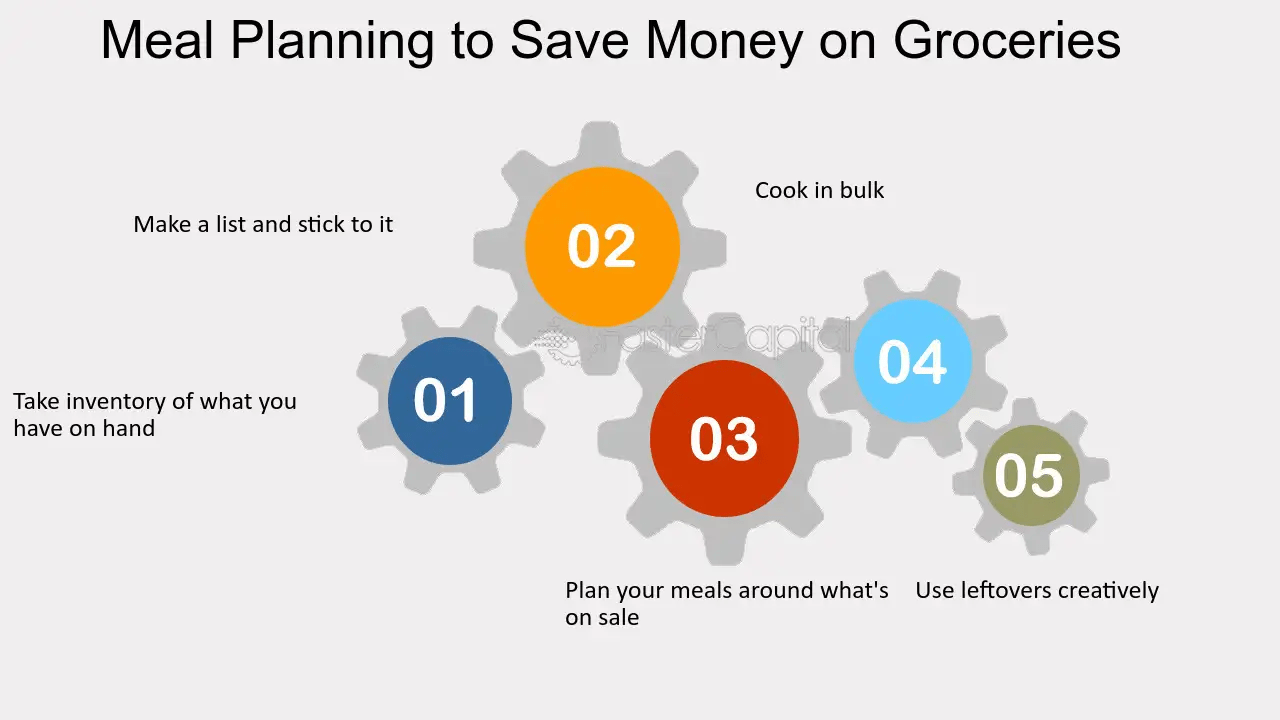

Strategies for Saving Money on Groceries and Household Expenses

One area where you can make a significant impact on your budget is groceries and household expenses. Start by planning your meals in advance and creating a shopping list. This helps you avoid impulse purchases and ensures that you only buy what you need. Consider buying in bulk for items with a long shelf life to take advantage of discounts. Make $950/Week Posting Premade Videos On YouTube!

Another strategy is to compare prices and shop at different stores. Take advantage of loyalty programs and coupons to save money on everyday items. Additionally, consider alternative brands or generic products, as they are often more affordable without sacrificing quality.

Reducing energy costs can also lead to substantial savings. Make it a habit to turn off lights when not in use, unplug electronic devices, and use energy-efficient appliances. Lowering your thermostat by a few degrees during winter and using fans instead of air conditioning during summer can also help reduce utility bills.

Tips for Reducing Utility Bills and Saving on Energy Costs

Utility bills can often eat up a significant portion of your budget, but there are ways to reduce them and save on energy costs. Start by conducting an energy audit of your home. Look for areas where you can improve insulation, seal drafts, and optimize heating and cooling systems. Simple actions like installing weatherstripping, using draft stoppers, and adding insulation can make a big difference.

Consider switching to energy-efficient light bulbs and appliances. While the initial cost may be higher, they consume less energy and have a longer lifespan, saving you money in the long run. Adjusting your thermostat and using programmable thermostats can help regulate indoor temperatures and reduce energy consumption.

Finally, be mindful of your water usage. Fix leaky faucets and toilets promptly, take shorter showers, and consider installing low-flow showerheads and faucets. These small changes can lead to significant savings on your water bill.

Cutting Down on Discretionary Spending and Entertainment Expenses

Discretionary spending, such as entertainment and dining out, can quickly add up and derail your budget. However, there are ways to enjoy leisure activities without breaking the bank. Start by setting a monthly entertainment budget and sticking to it. Look for free or low-cost alternatives, such as community events, movie nights at home, or exploring local parks and museums.

When dining out, opt for lunch specials or happy hour deals, as they often offer discounted prices. Consider cooking at home more often and exploring new recipes. Not only is it more cost-effective, but it can also be a fun and creative way to bond with family or friends.

To avoid impulse purchases, practice the 24-hour rule. When you find something you want to buy, wait 24 hours before making the purchase. Often, you’ll find that the initial desire fades, and you can make a more rational decision about whether it’s truly worth the expense. Make $30 Per Photo You Take!

Saving Money on Transportation and Travel Expenses

Transportation and travel expenses can consume a significant portion of your budget. However, there are strategies you can implement to save money in these areas. Consider carpooling or using public transportation instead of driving alone. This not only saves money on fuel but also reduces wear and tear on your vehicle.

Another option is to explore alternative modes of transportation, such as cycling or walking, for shorter distances. Not only does this save money, but it also promotes a healthier lifestyle. Additionally, consider using ride-sharing services or renting a car only when necessary, rather than owning a vehicle.

When it comes to travel, planning in advance can lead to substantial savings. Look for discounted flights, compare prices on different booking platforms, and be flexible with your travel dates. Consider staying in accommodations such as hostels or vacation rentals, which are often more affordable than hotels. Lastly, be mindful of your expenses during the trip by setting a daily budget and avoiding unnecessary splurges.

Investing and Growing Your Savings

While saving money is important, it’s equally crucial to make your savings work for you. Investing is a key strategy for growing your wealth over time. Consider consulting with a financial advisor to determine the best investment options based on your risk tolerance and financial goals.

Diversify your investments to reduce risk and maximize returns. Explore a range of investment vehicles, such as stocks, bonds, mutual funds, or real estate. Keep in mind that investing requires a long-term perspective, and it’s essential to stay informed and adjust your portfolio as needed.

Additionally, take advantage of employer-sponsored retirement plans, such as 401(k) or pension plans. Contribute the maximum amount allowed and take advantage of any matching contributions offered by your employer. These plans provide tax advantages and can significantly boost your retirement savings.

Tools and Resources for Tracking and Managing Your Finances

Tracking and managing your finances is essential for maintaining good money-saving habits. Fortunately, there are numerous tools and resources available to help you stay organized and make informed financial decisions. Start by using budgeting apps or online platforms that allow you to track your income, expenses, and savings goals in one place. Article Writers Can Make $250 Per Day!

Consider using expense-tracking apps to monitor your spending habits and identify areas where you can cut back. Automatic savings apps can help you save effortlessly by rounding up your purchases and depositing the difference into a savings account. Additionally, online banking provides easy access to your accounts, allowing you to monitor transactions and set up automatic bill payments.

Educate yourself by reading personal finance books, listening to podcasts, or following reputable financial blogs. There are also online courses and workshops available that can enhance your financial literacy and provide valuable insights into money management.

Conclusion: Creating a Sustainable Money-Saving Habit

Mastering money-saving habits is a journey that requires discipline, commitment, and patience. By understanding the benefits of saving money, the psychology behind it, and setting clear financial goals, you can create a solid foundation for your financial well-being.

Implement strategies to save money on groceries, household expenses, utility bills, discretionary spending, transportation, and travel. Consider investing your savings to grow your wealth and take advantage of the resources available to track and manage your finances effectively.

Remember, developing money-saving habits is not about deprivation or sacrifice; it’s about making conscious choices and aligning your spending with your values and long-term goals. Start small, be consistent, and celebrate your progress along the way. With time, you’ll create a sustainable money-saving habit that will bring you financial security and peace of mind.

Start implementing these money-saving strategies today and take control of your financial future. Remember, every small step counts, so start saving now and watch your savings grow.