Discover 15 Ingenious Tips to Supercharge Your Savings!

The Importance of Saving Money Saving money is an essential aspect of financial well-being. It provides a safety net for unexpected expenses, helps achieve long-term goals, and enables financial freedom. By saving, you can build wealth, create opportunities, and enjoy peace of mind. However, many people struggle to save due to various reasons such as lack of knowledge, discipline, or a clear plan. If you’re looking to supercharge your savings, here are some smart money tips to get you started. Post Images for $200 Per Day!

How to Set Achievable Savings Goals Setting achievable savings goals is the first step toward successful money management. Start by identifying your short-term and long-term financial objectives. Short-term goals may include saving for a vacation or purchasing a new gadget, while long-term goals could involve saving for retirement or buying a house. Once you’ve defined your goals, determine the amount of money you need and the time frame in which you want to achieve them. Break down your goals into manageable milestones, such as saving a certain percentage of your income each month. This approach will make your goals more attainable and less overwhelming.

Creating a Budget for Optimal Savings

A budget is a powerful tool that helps you track your income and expenses, ensuring that you spend less than you earn. To create an effective budget, start by calculating your monthly income from all sources. Then, list all your expenses, including fixed costs like rent or mortgage payments, utilities, and insurance, as well as variable expenses such as groceries, entertainment, and transportation. Analyze your spending patterns and identify areas where you can cut back or make adjustments. Allocate a portion of your income towards savings and make it a non-negotiable expense. Automating your savings will help you stay disciplined and consistent with your savings goals.

Smart Money-Saving Strategies

There are numerous smart money-saving strategies you can employ to stretch your dollars further. Consider adopting some of these habits:

- Couponing and Cashback: Take advantage of coupons, promotions, and cashback offers to reduce your expenses. This can be done both online and in physical stores.

- Meal Planning: Plan your meals in advance, create a shopping list, and stick to it. This will prevent impulse buying and reduce food waste.

- Energy Conservation: Save on utility bills by practicing energy-efficient habits such as turning off lights when not in use, using energy-saving appliances, and optimizing your home’s insulation. Earn $20 an Hour Listening to Spotify

- DIY Projects: Instead of hiring professionals for every task, try your hand at simple home improvement projects or repairs. This can save you a significant amount of money over time.

- Bulk Buying: Purchase non-perishable items in bulk to enjoy discounts and save money in the long run. Automating Your Savings for Success

Automating your savings is a game-changer when it comes to building a substantial nest egg. Set up automatic transfers from your checking account to a designated savings account each time you get paid. By doing so, you remove the temptation to spend the money impulsively. It becomes a habit, and you won’t even miss the funds. Over time, your savings will grow effortlessly, and you’ll be surprised by the progress you’ve made. Remember to review your savings plan periodically and adjust it as needed to align with your changing financial situation and goals. Investing Your Savings for Long-Term Growth

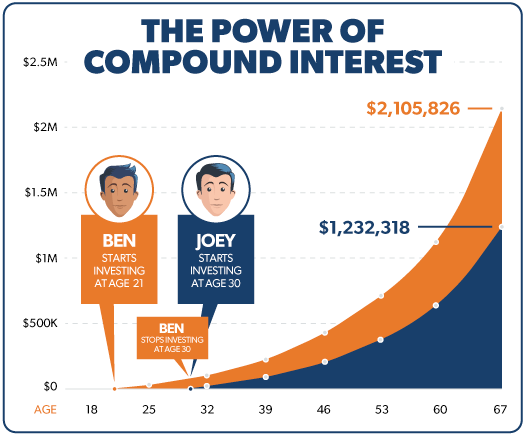

While saving money is crucial, investing your savings can help your money work harder for you. Consider investing in vehicles such as stocks, bonds, mutual funds, or real estate to grow your wealth over time. However, it’s important to educate yourself about different investment options, assess your risk tolerance, and seek professional advice if needed. Diversify your investments to minimize risk and maximize potential returns. Long-term investing allows you to benefit from compound interest, which is the next topic we’ll explore. Article Writers Can Make $250 Per Day!

The Power of Compound Interest

Compound interest is a magical concept that can significantly boost your savings over time. It is the interest earned on both the initial amount of money deposited and any accumulated interest. The longer you invest or save, the more compound interest works in your favor. By reinvesting the interest earned, your savings grow exponentially, leading to larger returns. Take advantage of compound interest by starting early and making regular contributions to your savings or investment accounts. The power of compound interest is most effective when time is on your side.

Saving on Everyday Expenses

Saving on everyday expenses can make a big difference in your overall financial picture. Here are some practical tips to help you cut costs:

- Review Subscriptions: Regularly assess your subscriptions for magazines, streaming services, or gym memberships. Cancel those you no longer use or need.

- Compare Prices: Before making a purchase, compare prices online or in different stores to ensure you get the best deal.

- Negotiate Bills: Negotiate with service providers such as internet, cable, or insurance companies to lower your monthly bills.

- Avoid Impulse Buying: Take a step back before making a purchase and ask yourself if you truly need it. Delaying gratification can prevent unnecessary expenses.

- Track Your Spending: Use budgeting apps or spreadsheets to keep track of your expenses and identify areas where you can cut back.

Making Smart Decisions with Your Money

Ultimately, making smart decisions with your money is vital for long-term financial success. Avoid impulsive purchases and focus on your goals. Before making a major financial decision, take the time to research, compare options, and seek advice if necessary. Educate yourself about personal finance topics, stay informed about changes in the market, and continuously improve your financial knowledge. By being proactive and intentional with your money, you’ll be well-equipped to make informed decisions that align with your financial goals.

15 Ingenious Tips to Supercharge Your Savings

Imagine this: you finally achieve that dream vacation in Bali, you confidently put a down payment on your dream home, and you sleep soundly knowing your future is financially secure. Sounds amazing, right? Well, the key to unlocking these realities lies in supercharging your savings.

But let’s be honest, saving money can feel like climbing Mount Everest – daunting, challenging, and sometimes frustrating. However, just like any worthwhile endeavor, with the right strategies and unwavering determination, you can conquer your financial goals and build a brighter future.

So, buckle up and get ready to transform your savings game with these 15 ingenious tips: How to make $1,000 per day on complete auto-pilot 24/7

1. Track Your Finances: Knowledge is Power

Before you start saving, you need to know where your money goes. Download a budgeting app, create a spreadsheet, or use the trusty pen and paper method to track your income and expenses for a month. This will help you identify spending leaks and areas where you can cut back.

2. Automate Your Savings: Set It and Forget It

Temptation is the enemy of savings. Make saving effortless by automating transfers from your checking account to your savings account every payday. This way, you’ll pay yourself first and ensure consistent savings without having to think twice.

3. Embrace the Power of the 52-Week Challenge:

Here’s a fun and effective way to boost your savings: the 52-week challenge. Start by saving $1 in week 1, $2 in week 2, and so on. By the end of the year, you’ll have accumulated a whopping $1,378!

4. Unleash the Inner Chef: Cook More at Home

Eating out can seriously dent your budget. Challenge yourself to cook more meals at home. Plan your meals for the week, buy groceries in bulk (when feasible), and explore budget-friendly recipes. You’ll not only save money but also potentially eat healthier.

5. Cancel Unused Subscriptions: Stop the Subscription Drain

How many streaming services, gym memberships, or magazine subscriptions do you never use? Take an inventory and cancel any unused subscriptions. Every little bit counts!

6. Embrace “No-Spend” Days/Weekends:

Challenge yourself to spend nothing (except for essentials like groceries and utilities) for a specific day or weekend. This will help you become more mindful of your spending habits and discover free and low-cost ways to entertain yourself.

7. Declutter and Sell:

Do you have unused items lying around the house? Turn them into cash! Organize a garage sale, utilize online selling platforms, or consider consignment shops. The extra income can significantly boost your savings.

8. Negotiate (Almost) Everything:

Don’t be afraid to negotiate! From your cable bill to your phone plan, gently inquire about potential discounts. You might be surprised at how much you can save with a simple conversation.

9. Embrace Free Entertainment:

There are countless free and affordable ways to have fun. Explore your city’s parks, and museums with free admission days, attend local events, or host game nights with friends.

10. Ditch the Convenience, Embrace the Alternative:

Instead of relying on convenient but expensive options like taxis or takeout, consider alternatives: walk, cycle, use public transport, and cook at home. These small changes can add up significantly.

11. Embrace the Power of Discounts:

Hunt for coupons, discounts, and loyalty programs before making purchases. Utilize apps that offer cashback or points rewards for everyday shopping. Every penny saved is a penny towards your goals.

12. Prioritize Needs over Wants:

Learn to differentiate between needs and wants. Before making a purchase, ask yourself: “Do I truly need this, or do I just want it?” Prioritize essential items and avoid impulse purchases. How To Make Money With YouTube!

13. Reward Yourself (Strategically):

Saving shouldn’t feel like a punishment. Set realistic milestones and reward yourself upon achieving them. However, choose rewards that don’t break the bank, like a relaxing spa day or a homemade gourmet meal.

14. Challenge Yourself to Save More:

Once you’ve mastered the basics, challenge yourself to save more. Try the “no-spend week” on a monthly basis or increase your automated savings amount by a small percentage.

15. Seek Support and Guidance:

Don’t be afraid to seek support and guidance on your financial journey. Talk to friends, family, or even a financial advisor for tips and motivation.

In conclusion, supercharging your savings requires a combination of discipline, planning, and smart money management strategies. Start by setting achievable goals, creating a budget, and automating your savings. Implement money-saving strategies, consider investing for long-term growth, and harness the power of compound interest. Save on everyday expenses and make informed decisions with your money. By adopting these practices, you’ll be well on your way to building a solid financial foundation and achieving your financial dreams.