Budgeting Basics: From Beginner to Pro

Clear steps and practical tips!

Budgeting Basics Introduction:

Congratulations on taking the first step towards financial freedom! It’s a decision that will have a ripple effect throughout all aspects of your life. Budgeting may seem daunting at first glance, conjuring images of complex spreadsheets and restrictive limitations. However, it’s crucial to shift that perspective. Budgeting isn’t about punishment or deprivation; it’s about empowerment. It’s about taking control of your finances, understanding where your money goes, and aligning your spending with your priorities and aspirations. How to make $1,000 per day on complete auto-pilot 24/7

Think of it like this: budgeting is the roadmap to your financial goals. Whether you dream of a comfortable retirement, that dream vacation, or simply achieving peace of mind knowing you have a safety net, a budget is the tool that will get you there. It allows you to make informed financial decisions, avoid impulse purchases that derail your progress, and channel your hard-earned money towards what truly matters to you.

This guide serves as your budgeting compass, tailored for both beginners and experienced budgeters alike. We’ll delve into the fundamentals of budgeting, explore different methods to find the perfect fit for your financial personality and equip you with strategies to streamline the process and ensure lasting success. By the end of this journey, you’ll have the knowledge and confidence to create a budget that works for you, transforming your relationship with money from a source of stress to a powerful tool for achieving your dreams.

This is more than just about mastering numbers on a page; it’s about taking a proactive role in shaping your financial future. As you build a budget that reflects your values and goals, you’ll gain a newfound sense of control and freedom. Imagine the peace of mind that comes with knowing exactly where your money goes, being prepared for unexpected expenses, and watching your savings steadily grow. Budgeting empowers you to break free from the cycle of living paycheck to paycheck and start building a life filled with financial security and the freedom to pursue your passions.

So, take a deep breath, embrace the possibilities, and let’s embark on this journey together. With the right tools and strategies, you can unlock the power of budgeting and transform your financial future, one step at a time.

Step 1: Embrace the Budgeting Mindset

Before diving into numbers, it’s crucial to shift your perspective towards budgeting. It’s not about restriction or deprivation; it’s about consciously directing your money towards your priorities and aspirations. Budgeting empowers you to make informed financial decisions, avoid impulse purchases, and achieve financial goals like saving for a vacation, paying off debt, or building an emergency fund.

Step 2: Know Your Numbers

The foundation of any solid budget is a clear understanding of your income and expenses. Want To Earn An Extra $2000 Per Month?

- Track your income: Gather your pay stubs, bank statements, or any other documents reflecting your income sources. Include salary, wages, side hustles, or any other regular earnings.

- Track your expenses: Monitor your spending habits for a month. Utilize bank statements, credit card bills, receipts, or budgeting apps to capture every expense, and categorize accordingly. Common categories include housing, food, transportation, utilities, debt payments, entertainment, and miscellaneous.

Step 3: Choose Your Budgeting Method

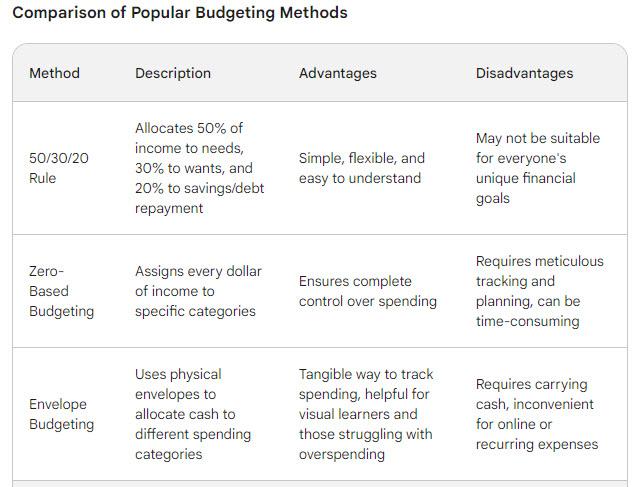

There’s no one-size-fits-all approach to budgeting. Explore different methods to find one that resonates with you: Now Hiring $30 Per Hour Facebook Chat Assistant!

- 50/30/20 Rule: Allocate 50% of your income to needs (housing, utilities, groceries), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. This is a simple and flexible starting point.

- Zero-Based Budgeting: Assign every dollar of your income to specific categories, ensuring your income and expenses balance perfectly. This method requires meticulous tracking and planning but offers complete control over your finances.

- Envelope Budgeting: Allocate cash to different spending categories using physical envelopes. This method is helpful for visual learners and those struggling with overspending in specific areas.

Step 4: Craft Your Budget

Now, it’s time to build your budget!

- Calculate your net income: Subtract taxes and other deductions from your gross income to determine your available spending money.

- Categorize your expenses: Group your expenses into categories identified in

- Compare income and expenses: Analyze if your income exceeds your expenses (surplus) or falls short (deficit).

- Set realistic goals: If you have a surplus, allocate funds towards savings and debt repayment goals. If you have a deficit, identify areas to cut back.

Step 5: Embrace Budgeting Apps and Tools

Technology can be your budgeting ally! Explore budgeting apps and tools that simplify the process:

- Track income and expenses automatically.

- Categorize transactions.

- Set spending limits and receive alerts.

- Generate reports and visualizations to understand your spending patterns.

Budgeting for Beginners: Pro Tips

- Start small and celebrate milestones: Don’t try to overhaul your finances overnight. Begin with small, achievable goals and celebrate your progress.

- Be flexible: Life happens! Unexpected expenses might arise, so build some flexibility into your budget to avoid derailing your progress.

- Review and adjust: Regularly review your budget, at least monthly, to adapt to changing circumstances and spending patterns.

Budgeting for Pros: Take it to the Next Level

- Embrace the 50/30/20 rule flexibly: Adjust the percentages to align with your unique financial goals. For example, prioritize saving for a down payment by allocating more than 20% towards savings.

- Automate your finances: Set up automatic transfers to savings and investment accounts, ensuring consistent progress towards your goals.

- Explore advanced budgeting techniques: Consider methods like envelope budgeting or zero-based budgeting for even greater control over your finances.

FAQs

- How often should I review my budget? It’s recommended to review your budget at least monthly. As your income or expenses change, adjust your budget accordingly. Post Images for $200 Per Day!

- What if I don’t have a regular income? Budgeting is still crucial! Use your average income over a specific period (e.g., 3 months) and estimate your expenses to create a workable plan.

- I tried budgeting, but I failed. What should I do? Don’t be discouraged! Budgeting is a continuous process. Analyze why your previous attempt failed and adjust your approach. Seek help from financial advisors or budgeting resources if needed.

Best Practices:

- Be honest with yourself: When tracking your expenses, accurately record every transaction, regardless of amount. This transparency allows you to identify areas for improvement and make informed financial decisions.

- Prioritize needs over wants: Allocate sufficient funds for essential expenses like housing, food, and transportation before allocating funds for discretionary spending.

- Cook more at home: Eating out regularly can significantly impact your budget. Explore cost-effective meal planning and cooking at home to save money while maintaining a healthy lifestyle.

- Shop around and compare prices: Don’t settle for the first option! Compare prices across different stores and brands before making purchases, especially for larger items. Consider generic brands and explore discount stores for additional savings.

- Unsubscribe from unused subscriptions: Regularly review your recurring subscriptions and cancel any services you no longer use. This seemingly small step can free up significant amounts of money over time.

Conclusion

Budgeting is a powerful tool that empowers you to take charge of your finances and build a brighter future. By understanding your income and expenses, choosing a suitable method, and consistently tracking your progress, you can achieve your financial goals and live a life aligned with your values. Remember, the journey to financial wellness is a marathon, not a sprint. Be patient, celebrate your milestones, and enjoy the process of taking control of your finances!

Quote: “Saving money is not about getting more money, it’s about spending less.” – Ashley Leconte