25 Tips for How to Save Money if Your

Paycheck Is Stretched Thin!

Introduction: Why saving money is important

Saving money is an essential aspect of financial stability and achieving long-term goals. Whether you are looking to build an emergency fund, pay off debt, or save for a dream vacation, having a solid savings plan is crucial. In this article, we will explore 25 practical tips on how to save money in various areas of your life. By implementing these strategies, you can take control of your finances and work towards a brighter future.

Budgeting and tracking expenses

Creating a budget is the first step toward effective money management. Start by listing your monthly income and expenses, including fixed bills, variable costs, and discretionary spending. Identify areas where you can cut back and set realistic savings goals. Additionally, tracking your expenses using budgeting apps or spreadsheets can provide insights into your spending habits and help you make necessary adjustments.

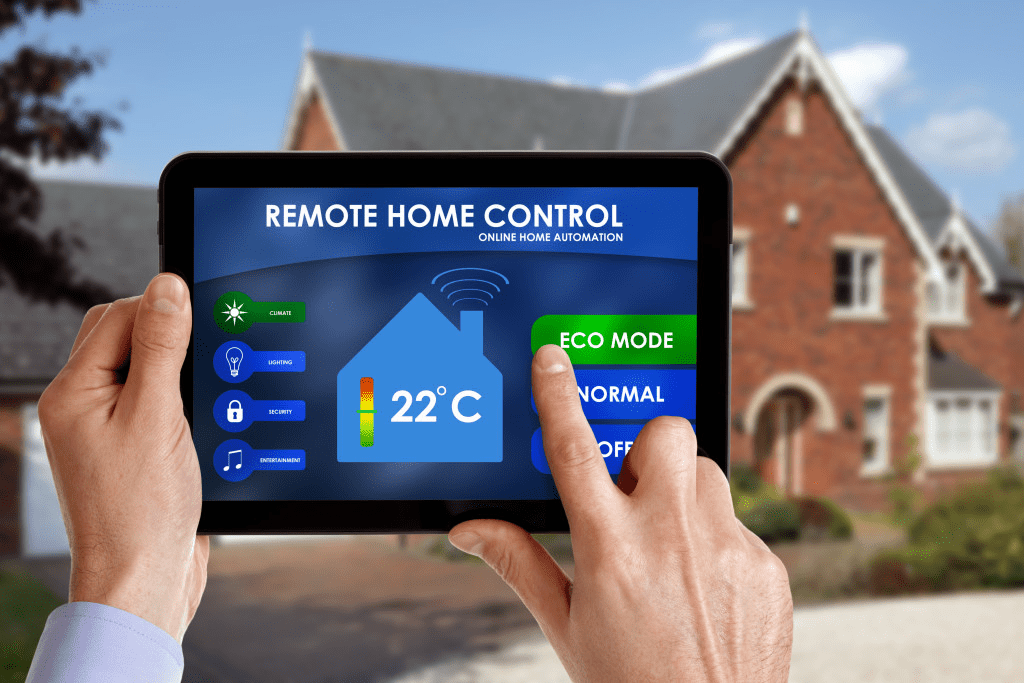

Cutting down on utility bills

Utility bills can eat up a significant portion of your monthly budget. To save money on electricity, consider switching to energy-efficient appliances, turning off lights when not in use, and adjusting your thermostat a few degrees lower in the winter and higher in the summer. Installing low-flow showerheads and faucets can help reduce water consumption and lower your water bills. Lastly, unplug electronics when they are not in use to avoid phantom power usage. Want To Earn An Extra $2000 Per Month?

Reducing transportation costs

Transportation expenses, including fuel, maintenance, and public transportation, can put a strain on your budget. Consider carpooling or using public transportation whenever possible to save on gas costs. Regularly maintain your vehicle to prevent costly repairs and improve fuel efficiency. If you live in a city with good bike lanes or walkable neighborhoods, opt for these alternatives to save money on commuting.

Saving on grocery shopping

Grocery shopping is an area where you can easily overspend if not careful. Start by making a list before heading to the store and stick to it. Avoid shopping when you’re hungry to resist impulse purchases. Take advantage of sales, discounts, and coupons to save money on your favorite products. Consider buying generic or store-brand items, as they are often just as good as name brands but at a lower price. Additionally, try shopping at local farmers’ markets for fresh produce at a better value.

Cooking at home and meal planning

Eating out at restaurants can quickly drain your bank account. Instead, try cooking at home and meal planning. Prepare your meals in advance, portion them out, and freeze them for busy days. This not only saves money but also ensures you have healthy, homemade meals readily available. Get creative with leftovers to eliminate food waste and stretch your grocery budget further.

Shopping smart and using coupons

Before making any purchase, do your research to find the best deals. Compare prices online and in-store to ensure you’re getting the best value for your money. Sign up for newsletters or loyalty programs to receive exclusive discounts and coupons. Use cashback apps or credit cards with rewards to earn money back on your purchases. By being a savvy shopper, you can save a significant amount of money over time.

Reducing entertainment expenses

Entertainment expenses, such as going to the movies or attending concerts, can quickly add up. Instead of splurging on expensive outings, look for free or low-cost alternatives. Rent movies or stream them at home instead of going to the theater. Explore local parks, museums, and community events for affordable entertainment options. Host game nights or potlucks with friends instead of dining out at expensive restaurants.

Cutting down on dining out

Eating out at restaurants is convenient but can be costly in the long run. Limit dining out to special occasions and treat it as a rare indulgence. Instead, learn to cook your favorite restaurant meals at home. Invite friends over for potluck dinners or organize a cooking club where each member takes turns hosting and preparing meals. Not only will you save money, but you’ll also develop new culinary skills.

Saving on travel and vacations

Traveling and vacations can be expensive, but with some smart planning, you can save money without compromising on fun. Look for off-season travel deals and explore destinations closer to home to save on airfare. Consider booking accommodations through vacation rental websites or staying with friends and family to cut down on hotel costs. Pack snacks and drinks for road trips to avoid pricey convenience store purchases. Earn $20 an Hour Listening to Spotify

DIY and home improvement savings

Home improvement projects can quickly become costly, but there are ways to save money while still achieving your desired results. Instead of hiring professional contractors, consider tackling smaller projects yourself. Watch tutorial videos and enlist the help of friends or family members with expertise in the area. Shop for materials during sales or look for second-hand items at thrift stores or online marketplaces.

Tips for saving on clothing and accessories

Clothing and accessories are necessary expenses, but they don’t have to break the bank. Start by decluttering your wardrobe and identifying items you no longer wear. Consider hosting clothing swaps with friends to refresh your wardrobe without spending money. Shop during sales, take advantage of discount codes and explore thrift stores or consignment shops for affordable fashion finds. Prioritize quality over quantity to build a versatile wardrobe that lasts.

Saving on healthcare and insurance

Healthcare and insurance costs can be a significant financial burden. To save money, review your insurance policies regularly and compare rates from different providers to ensure you’re getting the best deal. Take advantage of preventative care to avoid costly medical bills in the future. Utilize generic medications when possible and explore discount programs or prescription savings cards. Lastly, maintain a healthy lifestyle by exercising regularly and eating nutritious meals to reduce the risk of illness.

Technology and electronics are essential in today’s world, but they can also be expensive. To save money, consider buying refurbished or pre-owned devices instead of brand new ones. Research and compare prices before making a purchase, and wait for sales or promotional events to get the best deal. Take advantage of free software alternatives instead of purchasing costly programs. Additionally, consider selling or trading in old devices to offset the cost of upgrading.

Tips for reducing debt and interest payments

Debt can be a significant financial burden, but there are strategies to reduce it and save money on interest payments. Start by making a list of all your debts and prioritize them based on interest rates. Consider consolidating high-interest debts into a lower-interest loan. Increase your monthly payments whenever possible to pay off the debt faster and save on interest in the long run. Avoid taking on new debt and focus on living within your means. Make $950/Week Posting Premade Videos On YouTube!

Saving on education and learning resources

Education is invaluable, but it doesn’t have to be costly. Look for scholarships, grants, or financial aid options to reduce the burden of tuition fees. Consider attending community college or online courses, which are often more affordable than traditional universities. Utilize public libraries for free access to books, audiobooks, and educational resources. Take advantage of online platforms that offer free or low-cost courses on various subjects.

Reducing pet care expenses

Pets bring joy to our lives, but they can also be expensive to care for. To save money on pet care, buy pet supplies in bulk or look for deals at discount pet stores. Consider making homemade pet food or exploring more affordable brands that still meet nutritional requirements. Take advantage of preventive care to avoid costly veterinary bills. Additionally, groom your pets at home instead of relying on professional grooming services. Now Hiring $30 Per Hour Facebook Chat Assistant!

Saving on gift-giving and special occasions

Gift-giving and special occasions can strain your budget if not planned wisely. Instead of buying expensive gifts, consider homemade or personalized options that are more heartfelt and often cost less. Set a budget for gifts and stick to it. Look for sales and discounts throughout the year to purchase gifts in advance. Plan ahead for special occasions, such as birthdays or anniversaries, to avoid last-minute, expensive purchases.

Tips for saving on personal care and beauty products

Personal care and beauty products can be expensive, but there are ways to save money without sacrificing quality. Look for generic or store-brand alternatives that offer similar results at a lower price. Consider making your own beauty products using natural ingredients, which can be both cost-effective and healthier for your skin. Buy in bulk or during sales to stock up on essentials. Lastly, use products sparingly to make them last longer.

Saving on banking and financial services

Banking and financial services fees can add up over time. To save money, choose a bank that offers free checking and savings accounts without monthly maintenance fees. Utilize online banking services to avoid in-person transaction fees. Look for credit cards with no annual fees or high rewards programs that align with your spending habits. Regularly review your accounts and statements to identify any unnecessary fees and address them promptly.

Cutting down on alcohol and tobacco expenses

Alcohol and tobacco can be expensive habits that drain your budget. Consider reducing or eliminating these expenses altogether to save money and improve your health. Cut back on the number of drinks you consume when going out, or opt for non-alcoholic alternatives. Quitting smoking not only saves you money on tobacco but also reduces medical expenses in the long run. Seek support from friends, family, or support groups if needed.

Saving on home and auto maintenance

Home and auto maintenance expenses can catch you off guard if you’re not prepared. Regularly maintain your home by conducting routine inspections and addressing issues promptly. This prevents minor problems from turning into costly repairs. Learn basic DIY skills to handle small home repairs yourself. When it comes to your vehicle, follow the recommended maintenance schedule to prevent breakdowns and costly repairs down the line.

Tips for saving on childcare and parenting expenses

Childcare and parenting expenses can be significant, but with careful planning, you can save money without compromising your child’s well-being. Consider alternative childcare options, such as nanny shares or co-ops, which can be more affordable than traditional daycare centers. Look for scholarships or financial assistance programs for educational expenses. Buy baby items in bulk or explore second-hand options for items that are safe and in good condition.

Saving on hobbies and recreational activities

Hobbies and recreational activities are important for personal growth and relaxation, but they can also be costly. Look for free or low-cost alternatives to pricey hobbies. Explore outdoor activities, such as hiking or biking, that don’t require expensive equipment or memberships. Take advantage of community centers or local organizations that offer affordable classes or workshops. Consider swapping hobbies with friends to try new activities without spending money.

Conclusion: Achieving financial goals through smart saving

Saving money is a skill that requires discipline and conscious decision-making. By implementing these 25 tips in various areas of your life, you can develop a solid savings plan and work towards achieving your financial goals. Remember, saving money doesn’t mean sacrificing enjoyment or quality of life; it simply means making smart choices and being mindful of your spending habits. Start small and gradually incorporate these strategies into your daily life, and you’ll be amazed at how much you can save over time. Take control of your finances, prioritize your goals, and pave the way for a more secure and prosperous future.